XO INVESTMENTS’ services for private clients range from wealth management to pension advice.

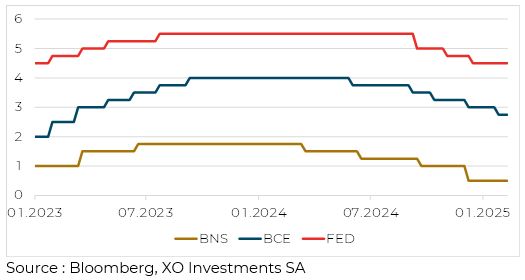

The year 2022 will go down in the annals of the bond asset class as a cataclysmic year, a necessary evil to control inflation. The central banks succeeded in their gamble by massively reducing price rises until they returned to a preshock situation. From 2024 onwards, with good inflation statistics, they were able to trigger a phase of monetary easing. The Swiss National Bank (SNB) initiated the move, before the ECB and then the FED implemented the same policy.

Although the election of Donald Trump and the prospect of tariff barriers has forced the Fed to pause, the outlook for all the major central banks’ key interest rates is rather bearish.

For the time being, this view is not being shared or implemented by the financial markets. The 10-year interest rate in the United States remains high (over 4%), with no significant fall in 2024. The global indices show similar statistics, with a yield of around 4%, at the same level as at the end of 2022 and with a similar duration of 7 years.

Despite this lag between movements in key rates and long-term rates, the bond asset class offers good prospects.

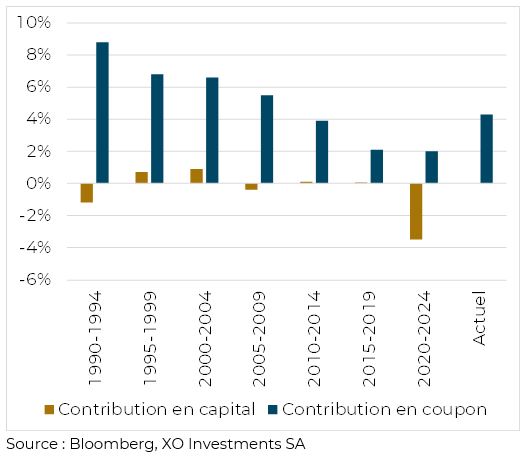

In addition to its ability to generate returns in a falling interest rate environment (capital contribution), the current market offers an attractive yield (coupon contribution), which has risen sharply over the last ten years.

Today, bond investments are attractive because they pay a higher rate of return than inflation.

This spread has never been so wide. It was even negative in 2020-2021. In other words, a traditional bond investment was unable to compensate for inflation during this period, resulting in a loss of purchasing power.

Bond yields, whether government or corporate, are higher than equity dividends on the US

market. This situation shows a cheap asset class in relative terms. The corporate segment offers a yield of around 5%, with a relatively small spread over US Treasuries.

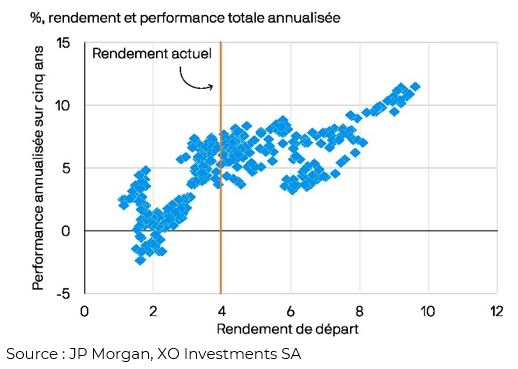

A final argument for attractiveness emerges when we look at the historical returns of global

bond indices and compare them with subsequent performances. With returns of 4%, almost all historical observations conclude the following 5-year period with a performance of over 5%. The only 5-year periods with negative returns follow periods when interest rates are around 2%.

The economic growth forecast for the United States is consistent with a steepening yield

curve. The slope of the yield curve is calculated as the difference between long-term rates (10 years) and short-term rates (2 years).

While this figure was negative in 2023, so the curve had a downward slope, synonymous with fears of inflation, it is now rising again. Good economic figures will allow the slope to steepen, confirming that the economy is in good health.

This technical configuration allows bond managers to take advantage of the roll-down

phenomenon, further enhancing the performance of the asset class.

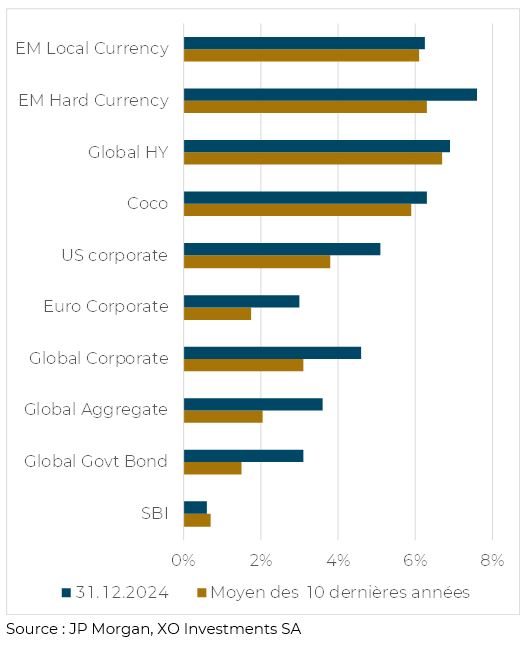

International bonds are not a homogenous group. Emerging market (EM) bonds do not have the same yield and risk characteristics as US corporate bonds or government bonds.

In all bond sub-classes, however, current yields are following the same trend: they are higher than the average yield over the last 10 years. It is interesting to note the higher yields to maturity on US corporate bonds than on European corporate bonds.

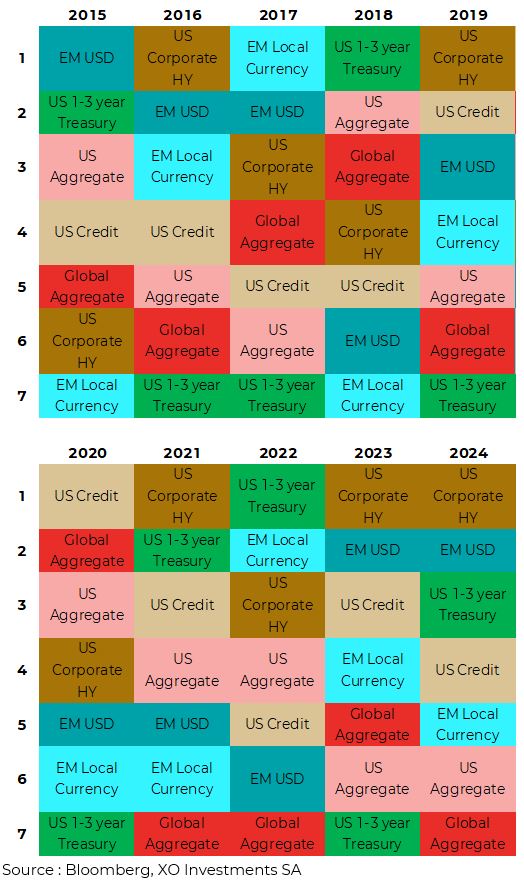

The difficulty in choosing these sub-asset classes lies in the underlying risk and the treatment of currencies (hedging or not). Unfortunately, each year is different and the rankings are different, making it difficult to forecast. Diversification therefore appears to be the best solution, within international bonds.

The downward trend in global interest rates and the attractive valuation of bonds compared with

equities offer investors good prospects of earning a return. This is particularly true for Swiss investors, who have been penalised by low yields on CHF bonds.

The steepening yield curve and the many opportunities within the bond market (US corporate bonds, emerging markets) should lead investors to hold on to as little liquidity as possible. The bond asset class benefits from a crucial force: the interest rate.

“Compound interest is the 8th wonder of the world. Those who understand it win, and those who don’t pay it”

Albert Einstein

Head Office

Fbg de l’Hôpital 10

2000 Neuchâtel

Copyright © 2025 XO Investments, All rights reserved. Proudly powered by The Swiss Peak

Head Office

Fbg de l’Hôpital 10

2000 Neuchâtel

Copyright © 2025 XO Investments, All rights reserved. Proudly powered by The Swiss Peak