XO INVESTMENTS’ services for private clients range from wealth management to pension advice.

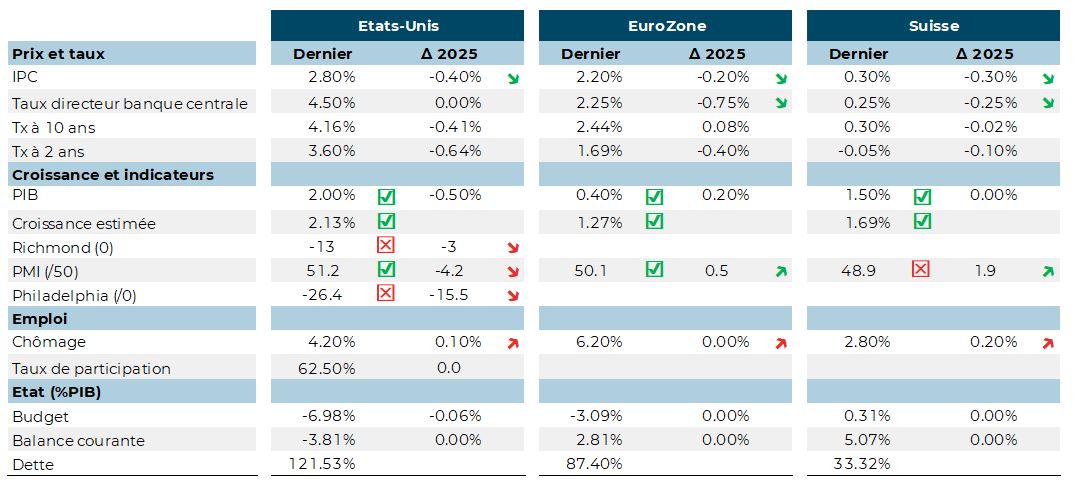

Donald Trump’s “Liberation Day” quickly turned into “Desolation Day” for markets and economists alike. Massive tariff hikes in the US, followed by aftershocks in China and Europe, have raised fears of a rapid return to inflation. Inflation expectations are on the rise in the United States, while actual inflation remains stable for the time being.

These inflationary fears have led the US Federal Reserve to maintain its interest rate levels, even as the outlook for unemployment darkens and the probability of an economic slowdown rises (30% probability), with the yield curve inverting. The FED chairman has no intention of changing his monetary policy and is waiting for real visibility on the Trump administration’s trade policy. Although President Trump eased his policy in the middle of the month, uncertainties remain high, which is having a negative impact on US consumer confidence, which has been falling for several weeks and is now at its lowest level since the inflationary peak in mid-2022. In Europe, Germany is putting in place a coalition between the CDU and the SPD. The minimum wage will rise from EUR 12.8 to EUR 15 per hour. Tax cuts are planned, as is a reduction in electricity tax. In France, the government has set a target of reducing the public deficit to 4.6% of GDP by 2026 by cutting public spending. However, the downturn in the growth outlook will make it difficult to achieve this target. Moody’s has decided not to update France’s sovereign debt rating because of the country’s political instability and the uncertainty surrounding the reduction in the budget deficit.

All European countries are expecting a slowdown in growth as a result of the US tariffs. The prospect of increased tariffs on China has temporarily triggered… an increase in Chinese exports! The Chinese government is trying to stimulate domestic demand to limit the impact of the trade war on the 20 million workers (3% of the workforce) exposed to US exports. New measures are therefore expected to stimulate consumption and de facto increase deficits.

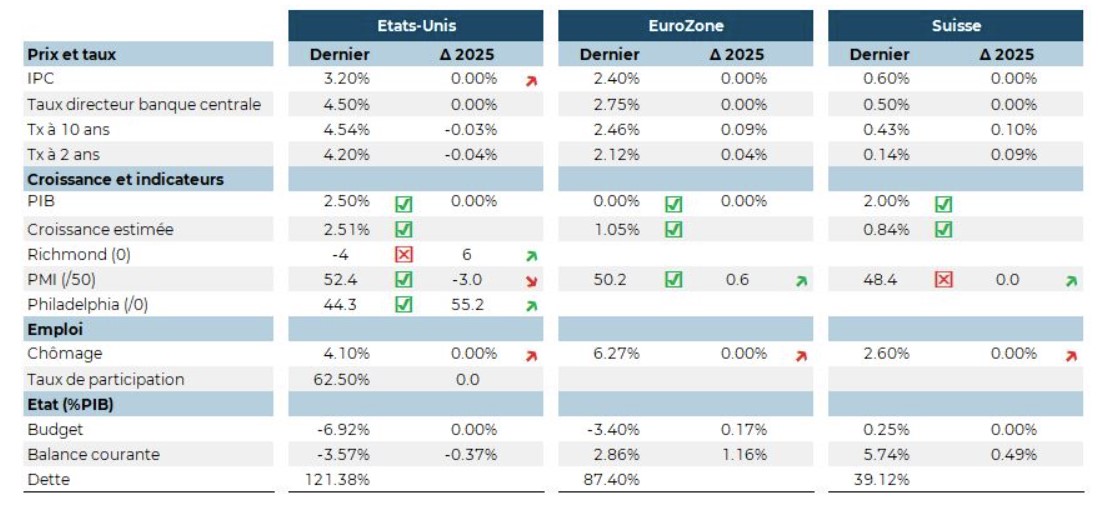

Donald Trump is giving his instructions this January: lower oil prices, lower US interest rates. Unfortunately, neither seems to be responding to his demands. With inflation picking up slightly (2.9% in December), the FED is putting on hold the cycle of rate cuts that began in September. Powell cites domestic political uncertainty as one of the reasons for the pause. If the tariff barriers imposed on Canada, Mexico and China were to rise, excess inflation of between 0.5% and 2% could emerge. From the Fed’s point of view, it is therefore urgent to wait for Donald Trump to clarify the implementation of his policy agenda. And the slowdown in wage growth offers a counterbalance to the impact of the tariffs.

Donald Trump is giving his instructions this January: lower oil prices, lower US interest rates. Unfortunately, neither seems to be responding to his demands. With inflation picking up slightly (2.9% in December), the FED is putting on hold the cycle of rate cuts that began in September. Powell cites domestic political uncertainty as one of the reasons for the pause. If the tariff barriers imposed on Canada, Mexico and China were to rise, excess inflation of between 0.5% and 2% could emerge. From the Fed’s point of view, it is therefore urgent to wait for Donald Trump to clarify the implementation of his policy agenda. And the slowdown in wage growth offers a counterbalance to the impact of the tariffs.