XO INVESTMENTS’ services for private clients range from wealth management to pension advice.

Switzerland, the cradle of watchmaking, organises its ‘Watches and Wonders’ Fine Watchmaking Fair in Geneva every April. The watch brands present unveil their new products, and it’s a chance for them to meet all their professional customers in the space of a few days. Unfortunately, the surprises were not confined to the show floor this year, as Donald Trump’s decision to raise export taxes on Swiss timepieces (+31%) has led the sector to fear a slowdown in a context that is already tense due to the difficulties in the Chinese market.

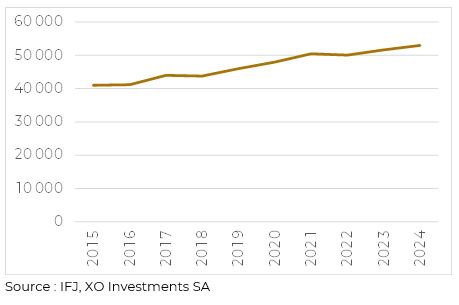

With more than 65,000 jobs, the watch industry is the country’s 3rd largest export sector, behind the chemical and machinery industries. The cantons of Neuchâtel, Berne and Geneva account for more than half of these jobs. Watch exports slowed by 2.8% in 2024, with an export value of more than CHF 25 billion. Switzerland accounts for only a fraction of the wristwatches sold in the world, but the largest in terms of value.

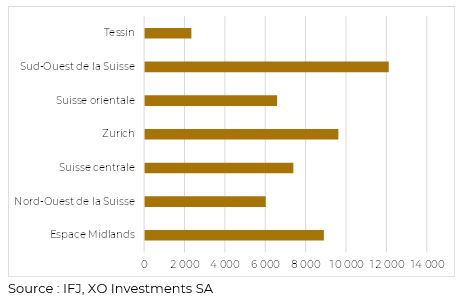

Given the importance of the American market to Swiss watchmakers, it is easy to understand their concern at Donald Trump’s decisions. With 17% of the market, the United States is ahead of China and Hong Kong. Japan is one of the top three export markets for Swiss watches. The leading European country is Great Britain, followed by France.

Over the last 25 years, Europe has seen its share of watch exports fall, to the benefit of the Middle East and Asia.

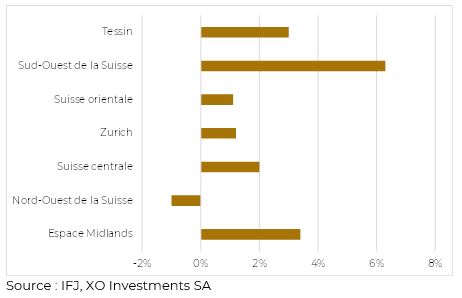

The decline in export figures between 2024 and 2022 is mainly due to China, which is down by more than 20%. This contraction is partly attributable to economic uncertainty in the Middle Kingdom and its impact on consumer behaviour. The United States has posted growth of more than 10% over the last two years, which is remarkable for a market of this size. Finally, India, which has just signed a free trade agreement with Switzerland and is negotiating special conditions for the watch market, is opening up new prospects for the sector.

The Swiss watchmaking export market is not an industrial market but a luxury market. 2/3 of the market in terms of export volume concerns timepieces priced at more than CHF 3,000.

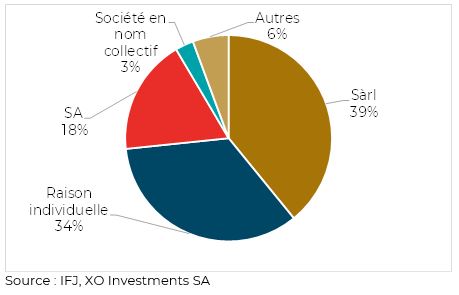

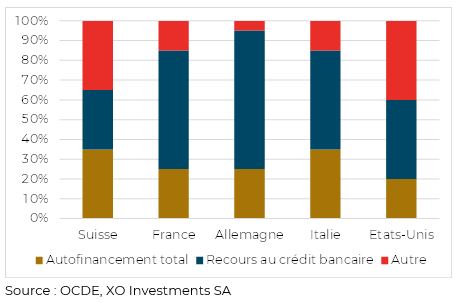

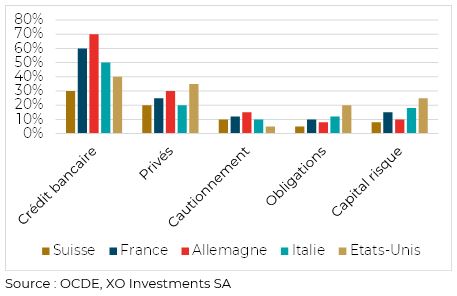

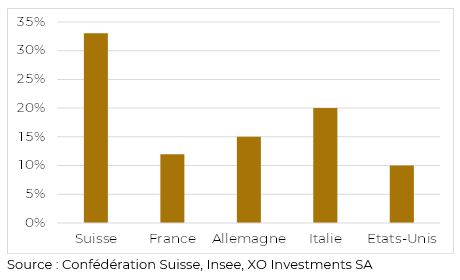

Le financement reste un enjeu majeur pour les PME. En Suisse, 35 % d’entre elles fonctionnent exclusivement par autofinancement, un taux record en comparaison internationale. L’Allemagne favorise largement le financement bancaire (70 %), tandis que les États-Unis recourent davantage au capital-risque et aux obligations.

Although 55% of exported watches are produced in steel versions, in terms of value it is watches using precious metals that account for almost 40% of the export value.

Despite its status as a luxury product, the way it is marketed is gradually changing over the generations. Younger generations (generation Z, for example) are turning away from physical shops, which are still widely present in major urban centres, to buy from the brands’ own websites. Brands must therefore adapt and become more present for these generations on such media.

The Swiss watch market is outrageously dominated by the giant from Biel and Geneva: Rolex. With an annual export value of over €10 billion, Rolex accounts for 30% of the market. Rolex is ahead of the Richemont group, which includes the second-largest Swiss watchmaker (Cartier), followed by Swatch, with Omega as its leading brand. LVMH is only in 3rd place. The world leader in luxury can currently count on only 6 watch brands, none of which has sales in excess of CHF 1 billion, a club reserved for just 7 brands.

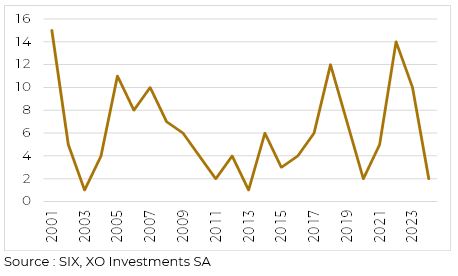

Financial markets traditionally represent a financial translation of a sector’s performance. Certain indices, for example, provide a visual indication of the watch industry’s stock market, and therefore financial, performance. This is the case of the BI Global Luxury Jewellery and Watches index, which includes Richemont (14%) and Swatch (7%). This index shows a very large fall in watchmaking stocks, in the same way as shares in the luxury sector as a whole (Hermès, LVMH, etc.)..

Head Office

Fbg de l’Hôpital 10

2000 Neuchâtel

Copyright © 2025 XO Investments, All rights reserved. Proudly powered by The Swiss Peak

Head Office

Fbg de l’Hôpital 10

2000 Neuchâtel

Copyright © 2025 XO Investments, All rights reserved. Proudly powered by The Swiss Peak