XO INVESTMENTS’ services for private clients range from wealth management to pension advice.

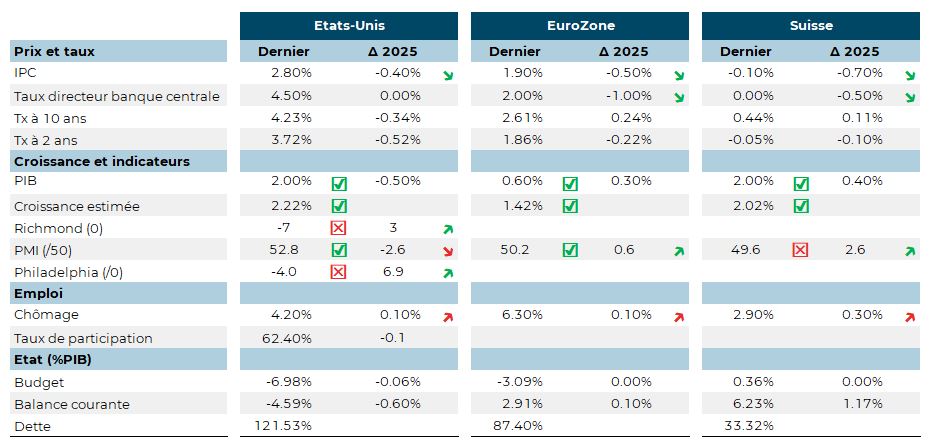

The bickering between Elon Musk and Donald Trump in June does not detract from the tensions surrounding trade negotiations. The deadline of early July for the first round of negotiations is approaching in a climate of pessimism for US consumers. The ISM manufacturing index contracted in May for the 3rd consecutive month. Despite these negative factors, the statistics show that inflation is contained but volatile, and first-quarter corporate earnings are better than expected, showing a degree of resilience to economic and trade uncertainties. As a result, the Federal Reserve left rates unchanged, while insisting on the need for further data before any easing.

Negotiations with China are progressing. The sharp fall in exports to the United States in May slowed overall growth in exports of goods. Imports also fell, illustrating the weakness of domestic demand. This phenomenon, coupled with underlying deflation, will probably lead the Chinese government to increase support for household consumption via fiscal policy, while rapidly seeking a compromise with the United States on trade policy.

In Europe, GDP growth in the eurozone for the first quarter of 2025 has been revised sharply upwards to +0.6% on the back of better exports from Germany and Ireland, probably in anticipation of tariff barriers.

The ECB cut its key interest rates to 2%. The institution has revised downwards its growth and inflation forecasts, which lead the President to consider that interest rates are close to neutral. The ECB is therefore likely to take a break from its policy of cutting interest rates.

The Swiss economy is relatively stable, buoyed by moderate inflation and a labour market that remains solid. The SNB has cut interest rates to 0%, while leaving the door open to further adjustments if the Swiss franc appreciates too strongly. The export industry continues to be penalised by weak global demand, particularly in Europe and China. The Swiss franc continues to act as a safe haven in an uncertain geopolitical environment, which is penalising the export industry.

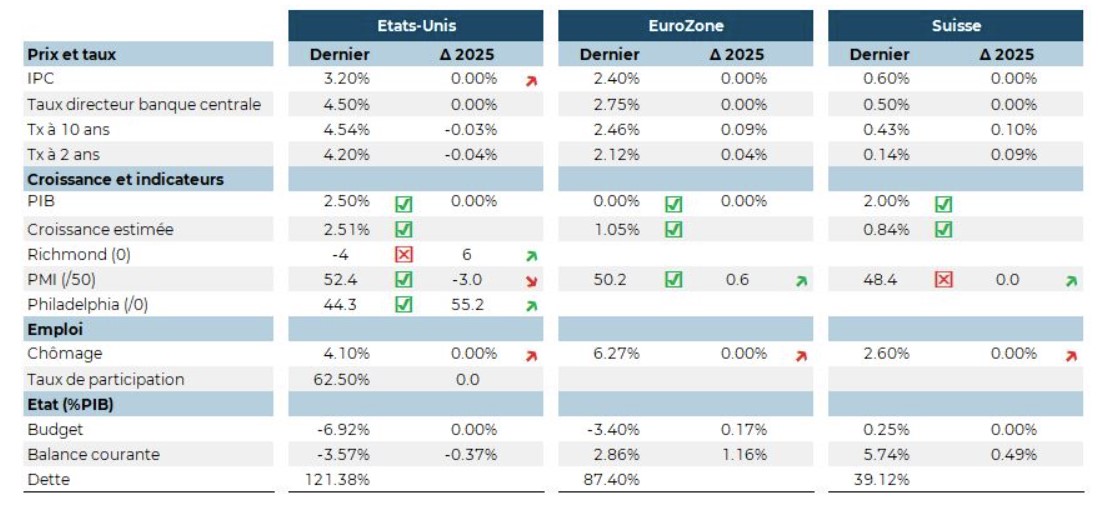

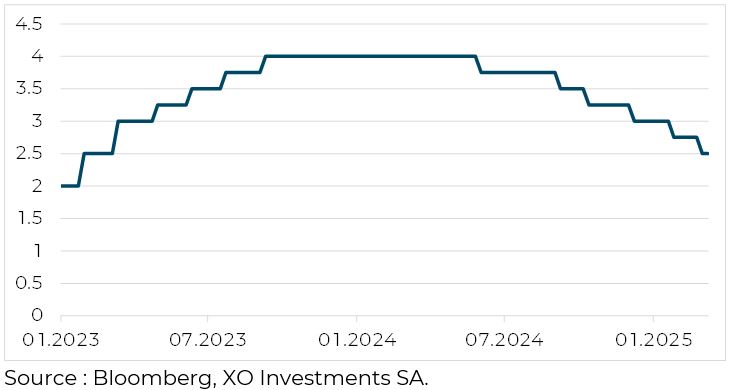

Donald Trump is giving his instructions this January: lower oil prices, lower US interest rates. Unfortunately, neither seems to be responding to his demands. With inflation picking up slightly (2.9% in December), the FED is putting on hold the cycle of rate cuts that began in September. Powell cites domestic political uncertainty as one of the reasons for the pause. If the tariff barriers imposed on Canada, Mexico and China were to rise, excess inflation of between 0.5% and 2% could emerge. From the Fed’s point of view, it is therefore urgent to wait for Donald Trump to clarify the implementation of his policy agenda. And the slowdown in wage growth offers a counterbalance to the impact of the tariffs.

Donald Trump is giving his instructions this January: lower oil prices, lower US interest rates. Unfortunately, neither seems to be responding to his demands. With inflation picking up slightly (2.9% in December), the FED is putting on hold the cycle of rate cuts that began in September. Powell cites domestic political uncertainty as one of the reasons for the pause. If the tariff barriers imposed on Canada, Mexico and China were to rise, excess inflation of between 0.5% and 2% could emerge. From the Fed’s point of view, it is therefore urgent to wait for Donald Trump to clarify the implementation of his policy agenda. And the slowdown in wage growth offers a counterbalance to the impact of the tariffs.