XO INVESTMENTS’ services for private clients range from wealth management to pension advice.

Switzerland is one of the countries hardest hit by the Trump administration’s customs duties, with tariffs of 39%. This 39% corresponds to the 39 billion trade deficit in goods between the United States and Switzerland. The 39 billion is largely due to exports of refined gold from Switzerland. While customs tariffs initially also applied to 1kg ingots, President Trump quickly changed his mind, ultimately exempting all gold exports, even though they were the cause of the US deficit…

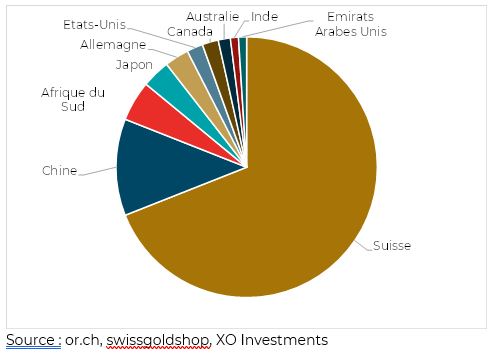

The turnaround on gold is simply a consequence of Switzerland’s dominant position in refining. Indeed, 70% of global refining is carried out in Switzerland, so it is easy to understand how such restrictions would make it difficult for the United States to source precious metals.

Switzerland holds this dominant position due to a number of factors. In particular, it is home to four of the world’s largest refineries. These refineries are renowned for their cutting-edge technology, their ability to produce ultra-pure gold, their compliance with LBMA Good Delivery standards and the traceability of their gold. In addition to these technical factors, the country’s neutrality, strategic geographical position, banking discretion and historical expertise naturally make it a partner of choice for geopolitical and strategic monetary activities.

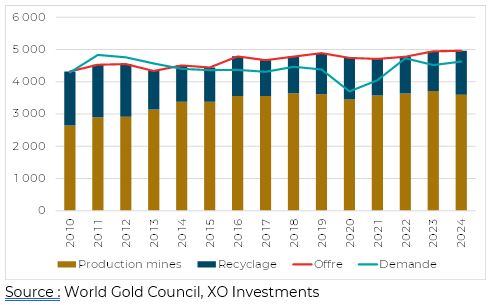

The gold supply amounts to 5,000 tonnes per year, broken down into 3,600 tonnes from mining and 1,400 tonnes from recycling per year. Supply has risen slightly over the past 15 years, with recycling remaining relatively stable over the period.Offre et demande d’or (tonnes)

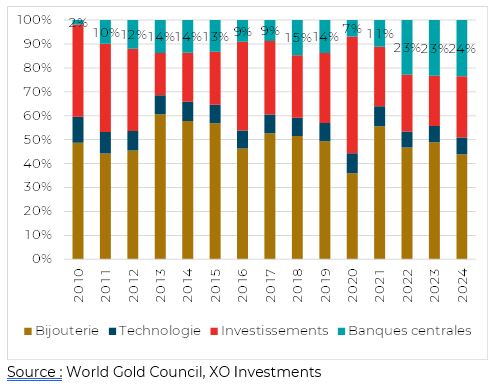

Demand for gold has been slightly lower than supply for the past 10 years. Four major sectors account for this demand: jewellery (45%), technology (5%), investment (26%) and central banks (24%). The latter has seen the most growth since 2010. Demand from central banks has exceeded the increase in supply over the period. Central banks have therefore more than captured the growth in gold production since 2010.

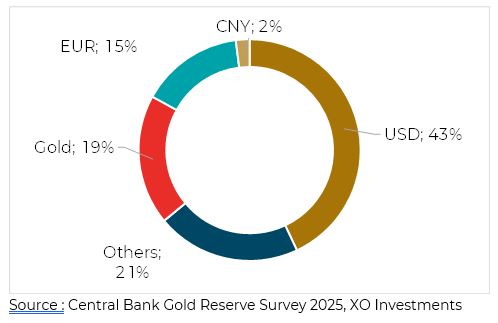

Central banks hold an average of 19% of gold on their balance sheets, making it the second most important currency after the USD.

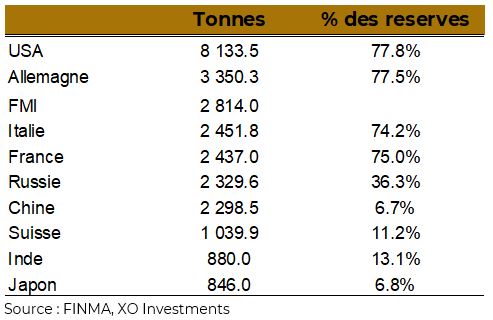

Nevertheless, the proportions vary greatly from one country to another. The United States remains the largest holder of gold, even though an audit of reserves, which have not been audited since 1954, promised by E. Musk, has not yet been carried out. European countries follow (Italy, France, Switzerland) as well as the major players in this world: Russia, China, India and Japan.

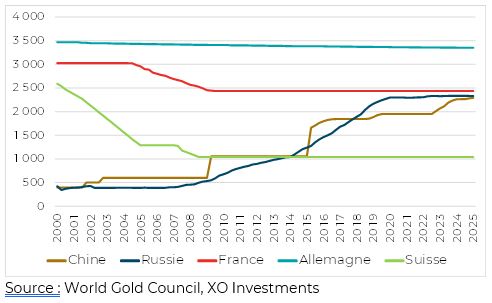

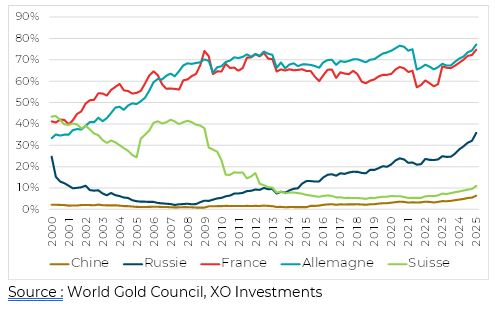

Changes in central bank holdings reflect geopolitical dynamics. For the past 25 years, Russia and China have been buying gold on a massive scale, acquiring nearly 2,000 tonnes. While Russia stepped up its purchases with the onset of the Ukrainian crisis in 2014, China has been proceeding in stages. The last three years have been marked by continuous purchases every month. On the other side of the spectrum, France and Switzerland sold gold in the early 2000s.

Thus, the percentage of reserves allocated to gold is rising sharply in Russia and China, although the latter still lags far behind European countries. It is difficult to imagine the massive purchases that would be necessary to achieve a similar percentage of holdings…

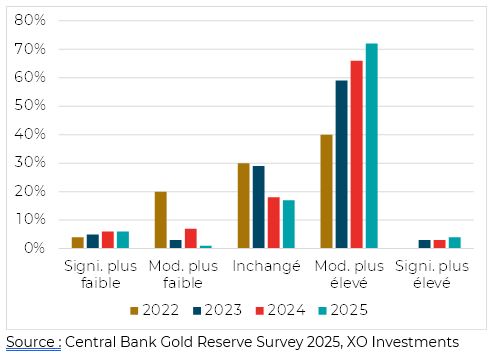

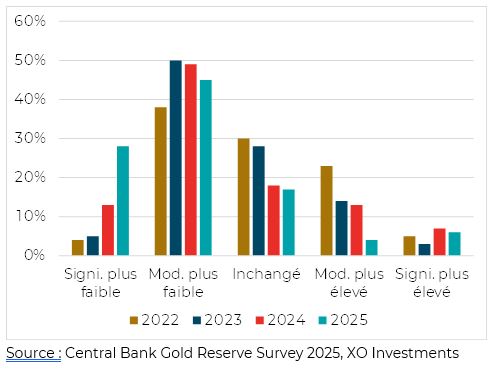

Every year, the World Gold Council conducts a survey of central bankers (73 respondents in 2025). This survey highlights a number of phenomena, in particular the place of gold in estimated reserves over the next five years. Three-quarters of respondents in 2025 believe that gold will see its share increase over the next five years. This sentiment is growing stronger with each passing year.

Conversely, central bankers believe that the USD will decline proportionally in central bank balance sheets, a response also given by nearly 75%.

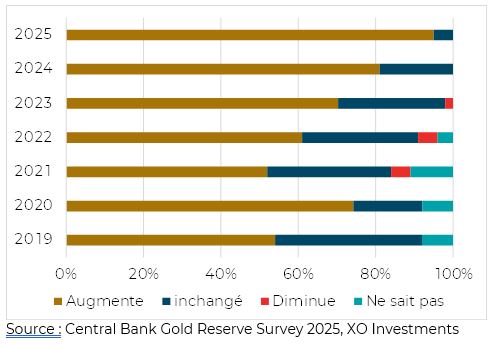

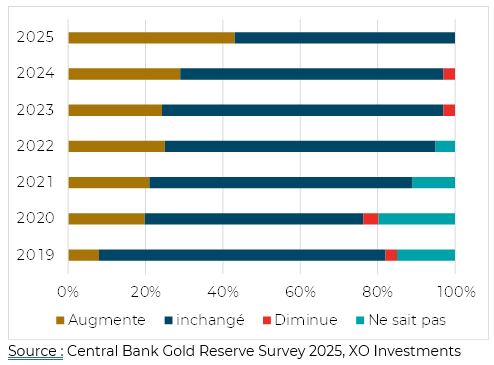

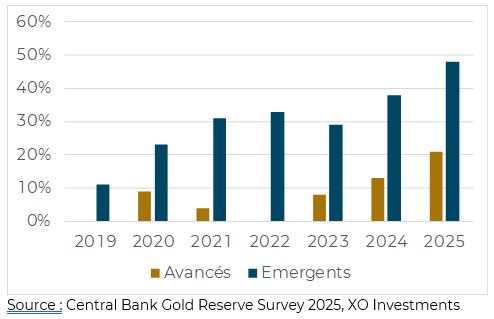

Over the next 12 months, 95% of respondents believe that gold reserves will increase on balance sheets, and 43% anticipate an increase on their own central bank balance sheets. This is therefore a major signal of central bank behaviour. It is mainly the central banks of emerging countries that are moving in this direction, confirming the massive purchases made by Russia and China.

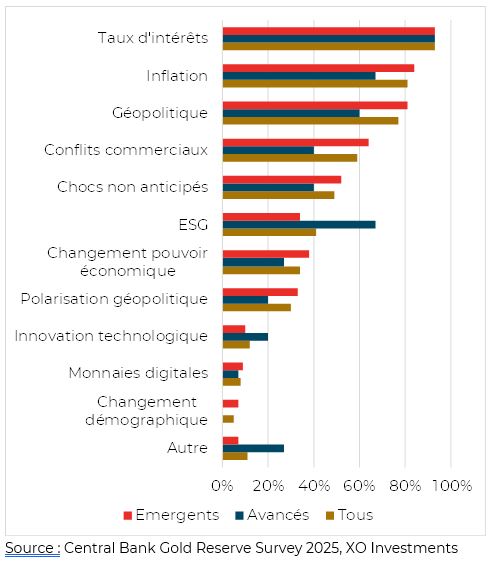

The management of a central bank’s balance sheet serves many purposes. The three main areas of interest identified in the annual study on central bank reserves are interest rate management, inflation management and geopolitics. However, the issues considered relevant by central bankers differ between central banks in Western countries and those in emerging countries.

For example, ESG (Environmental, Social and Governance) is a Western concern, not an emerging one. Conversely, central banks in emerging countries give greater weight in their decisions to issues such as trade conflicts, shifts in economic power, geopolitics and geopolitical polarisation. The world is gradually fragmenting into two camps.

These behaviours and perspectives have led central banks to become major players in the gold market in recent years, as they obviously were during the gold standard or gold exchange standard era. Central banks in emerging countries are gradually diverging from their Western counterparts for geopolitical reasons. De-dollarisation and geopolitical risks (sanctions on the Russian central bank with the war in Ukraine) are leading to a multipolar world where gold is becoming, or returning to being, a major management tool. There is no doubt that the movement in gold in recent years is not a flash in the pan.

‘Gold is the sovereign of sovereigns.’ Antoine de Rivarol.

Head Office

Fbg de l’Hôpital 10

2000 Neuchâtel

Copyright © 2025 XO Investments, All rights reserved. Proudly powered by The Swiss Peak

Head Office

Fbg de l’Hôpital 10

2000 Neuchâtel

Copyright © 2025 XO Investments, All rights reserved. Proudly powered by The Swiss Peak