XO INVESTMENTS’ services for private clients range from wealth management to pension advice.

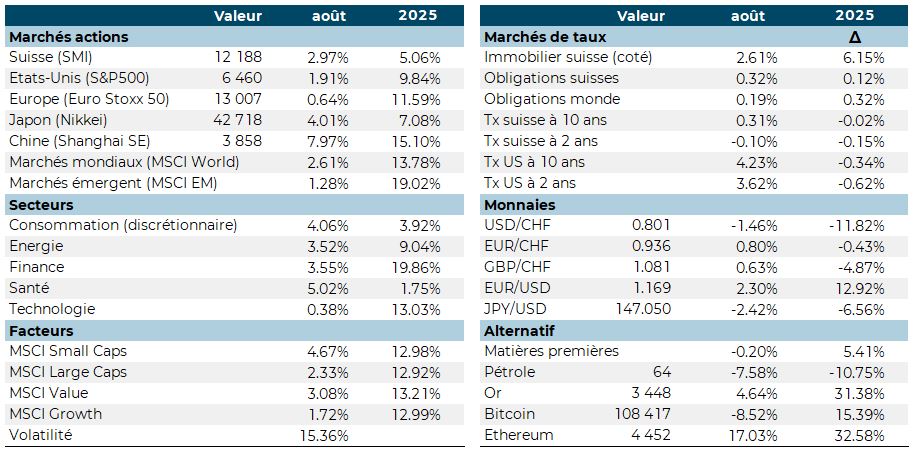

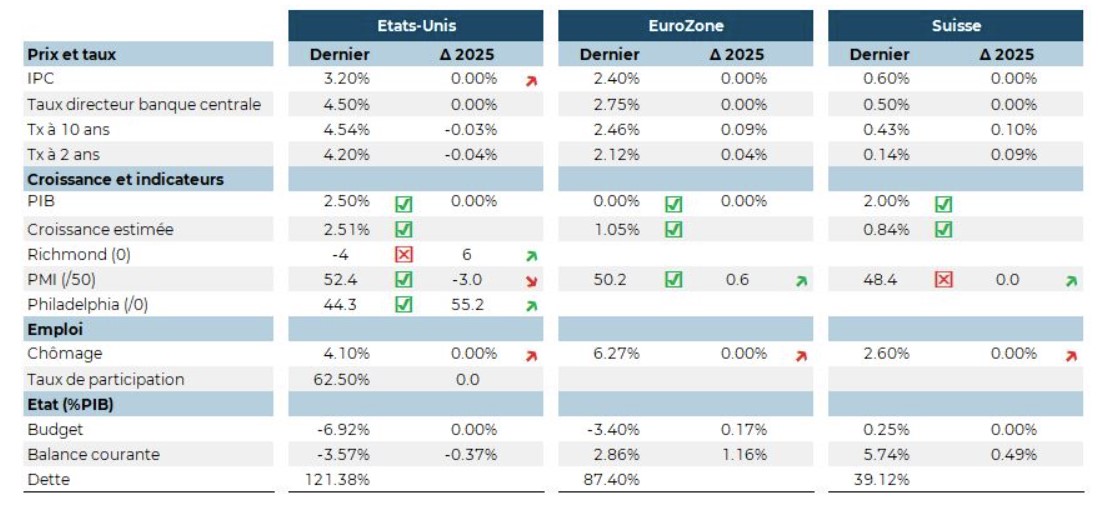

The Fed chairman is now leaving the door open to an interest rate cut. Regardless of the real reasons, President Trump will be able to claim victory following the pressure he exerted and ultimately boast: ‘In the end, it’s always Donald Trump who decides!’ All he has to do is wait long enough. This decision sent the markets soaring. Emerging markets, led by China, are driving the movement. The choice of style (small vs large, value vs growth) is not important this year; it is sector selection that makes the difference.

Interest rates have remained within a relatively narrow range since the beginning of the year, leading to relatively poor bond performance. Swiss real estate is performing well in a very low interest rate environment. The USD is under pressure in anticipation of rate cuts, allowing gold and precious metals to continue their strong year.

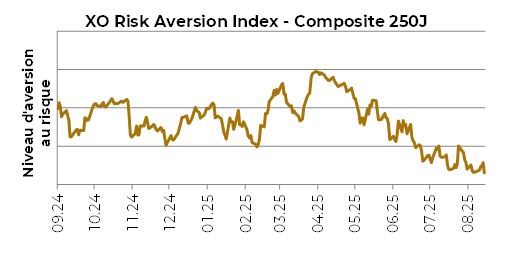

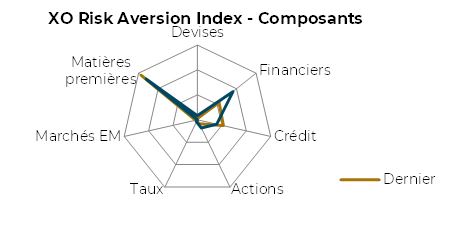

The risk indicator remains low in August, as do all sub-indices except commodities.

Donald Trump is giving his instructions this January: lower oil prices, lower US interest rates. Unfortunately, neither seems to be responding to his demands. With inflation picking up slightly (2.9% in December), the FED is putting on hold the cycle of rate cuts that began in September. Powell cites domestic political uncertainty as one of the reasons for the pause. If the tariff barriers imposed on Canada, Mexico and China were to rise, excess inflation of between 0.5% and 2% could emerge. From the Fed’s point of view, it is therefore urgent to wait for Donald Trump to clarify the implementation of his policy agenda. And the slowdown in wage growth offers a counterbalance to the impact of the tariffs.

Donald Trump is giving his instructions this January: lower oil prices, lower US interest rates. Unfortunately, neither seems to be responding to his demands. With inflation picking up slightly (2.9% in December), the FED is putting on hold the cycle of rate cuts that began in September. Powell cites domestic political uncertainty as one of the reasons for the pause. If the tariff barriers imposed on Canada, Mexico and China were to rise, excess inflation of between 0.5% and 2% could emerge. From the Fed’s point of view, it is therefore urgent to wait for Donald Trump to clarify the implementation of his policy agenda. And the slowdown in wage growth offers a counterbalance to the impact of the tariffs.

Head Office

Fbg de l’Hôpital 10

2000 Neuchâtel

Copyright © 2025 XO Investments, All rights reserved. Proudly powered by The Swiss Peak

Head Office

Fbg de l’Hôpital 10

2000 Neuchâtel

Copyright © 2025 XO Investments, All rights reserved. Proudly powered by The Swiss Peak