XO INVESTMENTS’ services for private clients range from wealth management to pension advice.

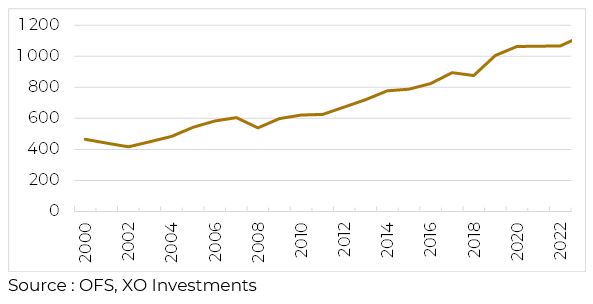

XO Investments is celebrating its 25th anniversary in 2025. A quarter of a century in a sector that has been turbulent, even chaotic: the tech bubble, the 2008 financial crisis, the end of banking secrecy in 2009 and the Swiss government’s bailout of UBS, the European debt crisis in 2010-2011, Covid in 2020, the implementation of the LSFin and LEFin (new laws concerning financial institutions), the bankruptcy of Credit Suisse and its merger with UBS in a single weekend… All this without taking into account traditional market movements, changes in trends, geopolitical events impacting financial assets… 25 years at the heart of the Swiss financial world, which continues to progress despite all these headwinds. In 2025, nearly CHF 9 trillion is administered and managed in Switzerland.

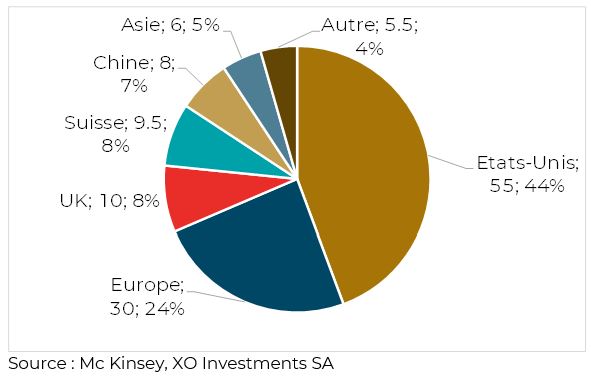

This record figure represents more than a doubling of assets under management in 25 years. Switzerland remains a pillar of global wealth management, behind the United States, Europe and the United Kingdom. With 8% of assets under management, it still ranks ahead of China.

Switzerland benefits from essential qualities that attract capital: political, economic and legal stability, industrial peace and independence. After two decades of decline in its share of global wealth management, its relative importance has stabilised in recent years.

In addition to assets under management for private individuals, whether from Switzerland or abroad, institutional asset management continues to play an important role in Switzerland. Accounting for 13% of total assets under management in Switzerland, the CHF 1.1 trillion in assets held by Swiss pension funds are increasingly attracting the attention of financial players.

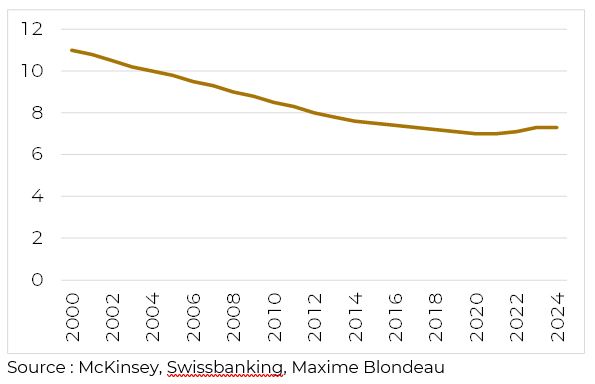

Despite its relatively small size, Switzerland competes with the United States, China and Europe in the financial sector. Like all service exporters in Switzerland, the sector is constantly seeking to improve productivity and the services it offers

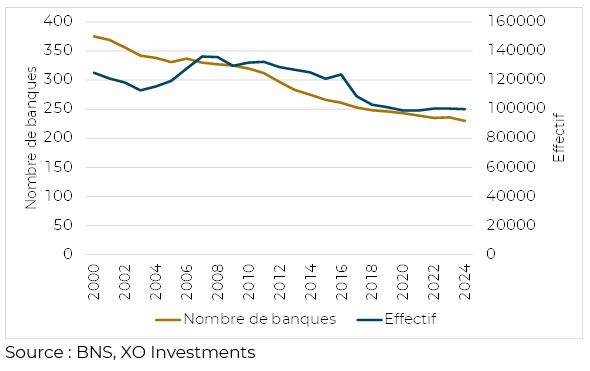

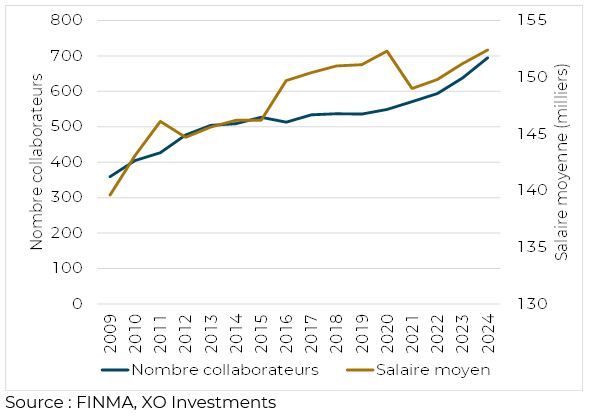

This necessity, combined with regulatory pressure, is leading the sector to concentrate on an ever-smaller number of players. The number of banks continues to decline, reaching 230 institutions in 2024, a 40% reduction in 25 years. Banking staff numbers are following the same trend, with the sector currently employing 100,000 people.

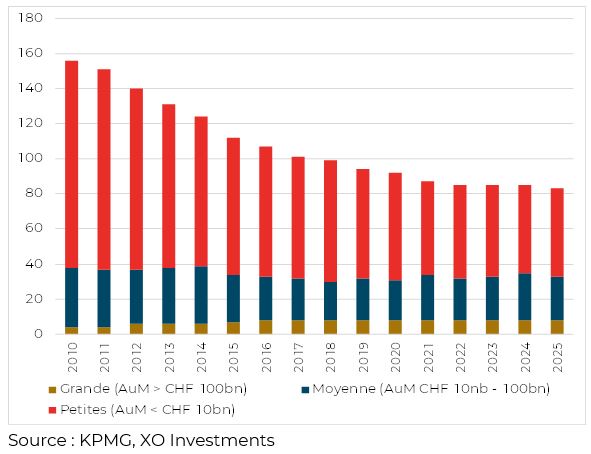

Private banks, the face of the Swiss financial centre, are following the same trend: fewer and larger banks. A ‘Big 8’ of eight large private banks managing more than CHF 100 billion will spearhead the 83 private banks in 2024, a far cry from the 158 private banks supervised by FINMA in 2010. The decline in the number of private banks is mainly attributable to the massive decline in small private banks managing less than CHF 10 billion, their number having fallen by 60% since 2010. Banks are therefore forced to grow… or die

Regulatory pressure is obviously a factor in this widespread consolidation of institutions. The financial regulator, FINMA, is imposing new rules and greater administrative requirements than in the past.

More surveillance, more controls, leading to a ‘virtuous’ or ‘vicious’ circle depending on which perspective one seeks to defend. FINMA is therefore growing in line with new regulations. With 700 employees in 2024, the regulatory authority has doubled in size since 2009

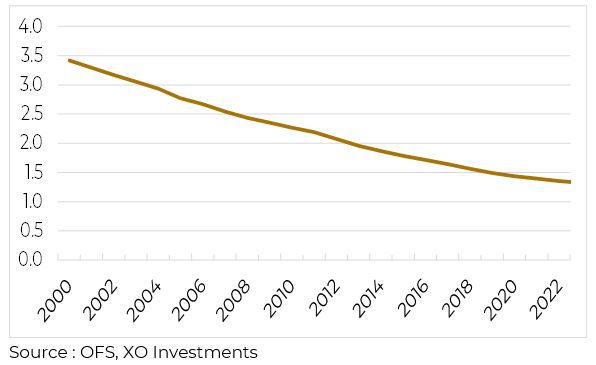

A trend towards consolidation is affecting all sectors of finance and insurance. Pension funds are no exception, with a 60% reduction in the number of players over the past 25 years.

This also applies to third-party managers or independent managers. A third-party manager is a player, independent of banks, who manages their client’s assets on the basis of a power of attorney, a management mandate, on the bank account or deposit in their client’s name.

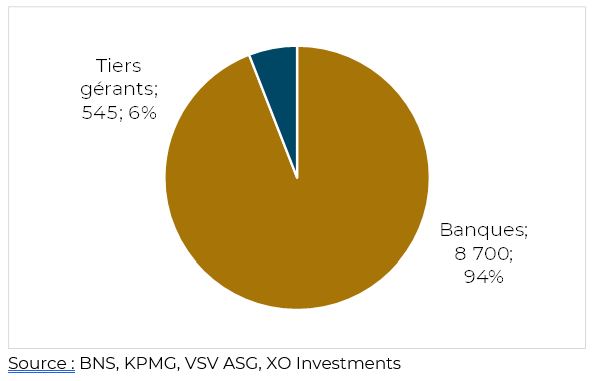

6% of assets managed in Switzerland are

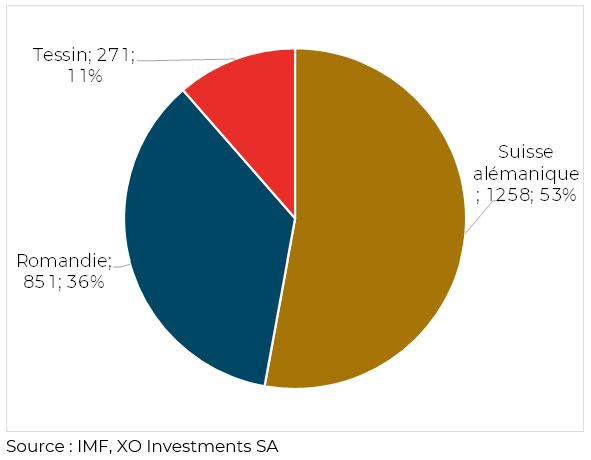

managed by third-party managers, representing just over CHF 500 billion. In 2021, almost 2,400 entities were registered with FINMA. 53% are located in German-speaking Switzerland, 36% in French-speaking Switzerland and 11% in Ticino.

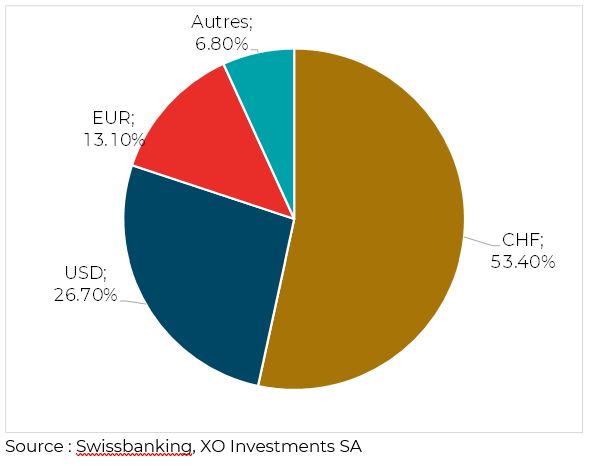

Third-party managers administer accounts mainly in CHF, but not necessarily for Swiss clients. Many foreigners (from Asia, Africa, or South America) seek to diversify their holdings of local currencies, which is why CHF and USD are the two main currencies managed by these independent players.

The implementation of the LSFin in 2021 triggered a process of reducing the number of regulated entities. There are now 1,600 such entities. The reduction is not due to mergers, which are still very rare, but to the cessation of activity by the smallest third-party managers. According to FINMA, an average entity is a structure of three people managing only CHF 180 million.

This small size allowed for a level of flexibility that would be impossible for a banking institution, but today it forces independent managers to resolve numerous dilemmas: how to maintain the freedom and flexibility promised to clients while being subject to increasingly stringent regulation? Third-party asset managers are facing multiple pressures: regulatory pressure, margin pressure, pressure from custodian banks, competition from private bankers, etc. Financial intermediaries in the broad sense (third-party asset managers, financial advisors registered with FINMA, insurance brokers, etc.) are facing their future and major entrepreneurial choices.