XO INVESTMENTS’ services for private clients range from wealth management to pension advice.

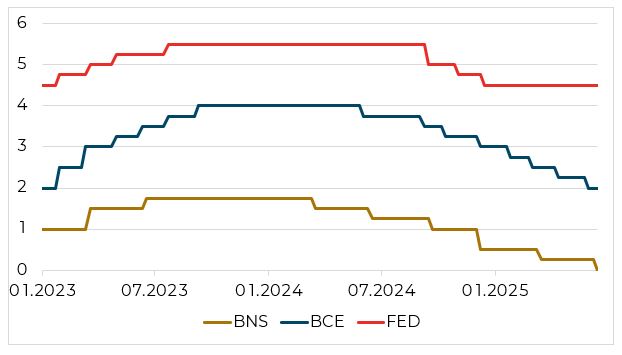

The pivot in monetary policy implemented by the Fed appears to be imminent. In his eagerly awaited speech at Jackson Hole, Jerome Powell opened the door to a cut in interest rates if risks in the labour market were confirmed. This change in interest rates is at the heart of ongoing tensions with President Trump. A change in monetary policy in the United States will obviously have implications for policies in other currency areas.

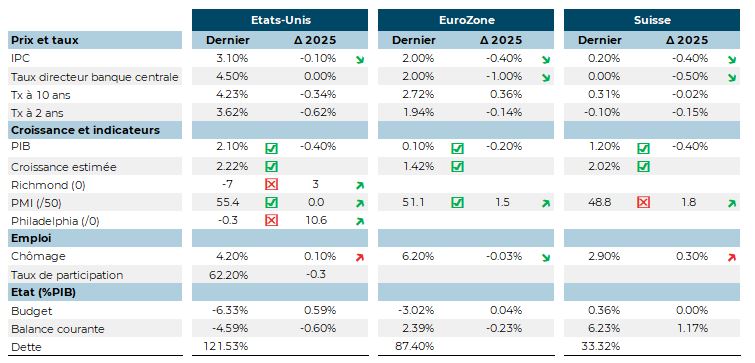

The Fed chairman remains cautious, however, given the uncertainties surrounding inflation, particularly following the sharp rise in producer prices in July (+3.3%). Inflation is largely under the control of President Trump’s customs policy, with the introduction of customs duties and the reduction in inventories built up by companies to temporarily adapt to them. Growth in the United States is solid, rebounding to +3% in the second quarter of 2025, above analysts’ expectations. Job creation, on the other hand, was disappointing, with 73,000 jobs created compared to the 104,000 expected in July. The biggest shock was the revision of previous data, reducing job creation in May and June to zero. This revision led to the dismissal of the head of statistics at the US Labour Office.

In Europe, manufacturing indices are up despite US tariffs, raising hopes of a rebound in growth after a negative first quarter at -0.6%. Switzerland is much more affected by tariffs set at 39%, and there is cause for concern after growth of +0.1% in the second quarter of 2025. Inflation remains stable in Europe at 2%, but is rising to 0.2% in Switzerland… The Swiss government is planning various measures to support businesses.

In Europe, manufacturing indices are up despite US tariffs, raising hopes of a rebound in growth after a negative first quarter at -0.6%. Switzerland is much more affected by tariffs set at 39%, and there is cause for concern after growth of +0.1% in the second quarter of 2025. Inflation remains stable in Europe at 2%, but is rising to 0.2% in Switzerland… The Swiss government is planning various measures to support businesses.

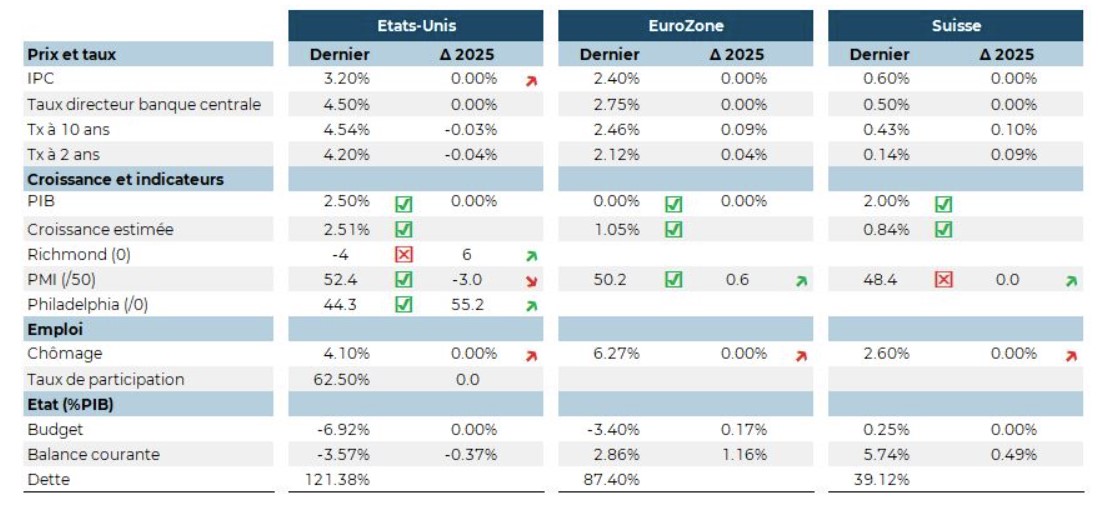

Donald Trump is giving his instructions this January: lower oil prices, lower US interest rates. Unfortunately, neither seems to be responding to his demands. With inflation picking up slightly (2.9% in December), the FED is putting on hold the cycle of rate cuts that began in September. Powell cites domestic political uncertainty as one of the reasons for the pause. If the tariff barriers imposed on Canada, Mexico and China were to rise, excess inflation of between 0.5% and 2% could emerge. From the Fed’s point of view, it is therefore urgent to wait for Donald Trump to clarify the implementation of his policy agenda. And the slowdown in wage growth offers a counterbalance to the impact of the tariffs.

Donald Trump is giving his instructions this January: lower oil prices, lower US interest rates. Unfortunately, neither seems to be responding to his demands. With inflation picking up slightly (2.9% in December), the FED is putting on hold the cycle of rate cuts that began in September. Powell cites domestic political uncertainty as one of the reasons for the pause. If the tariff barriers imposed on Canada, Mexico and China were to rise, excess inflation of between 0.5% and 2% could emerge. From the Fed’s point of view, it is therefore urgent to wait for Donald Trump to clarify the implementation of his policy agenda. And the slowdown in wage growth offers a counterbalance to the impact of the tariffs.