XO INVESTMENTS’ services for private clients range from wealth management to pensions advice.

Donald Trump is waging a veritable trade war against all his competitors. The weapon of tariffs is being used to protect American industry, repatriate activities to American soil and negotiate.

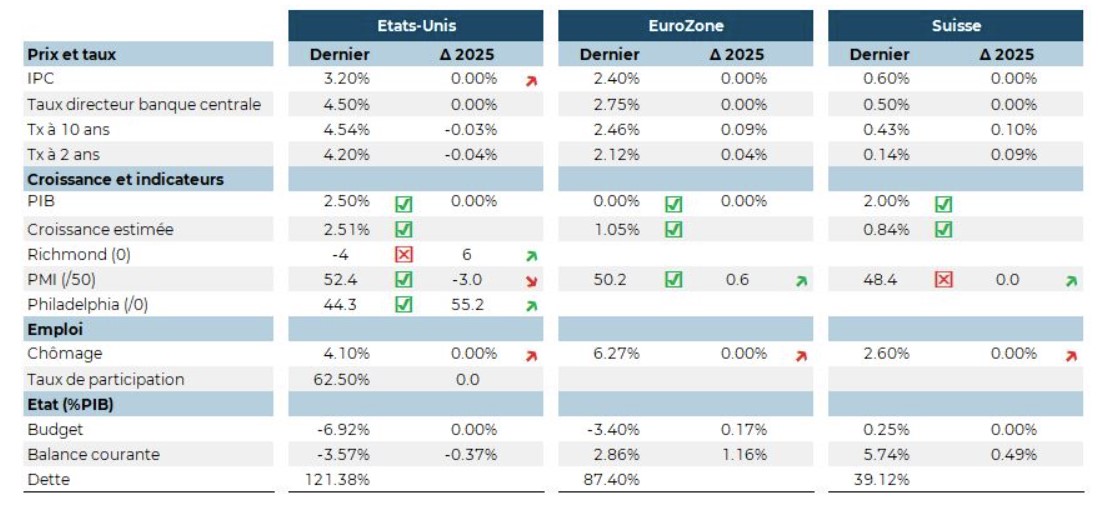

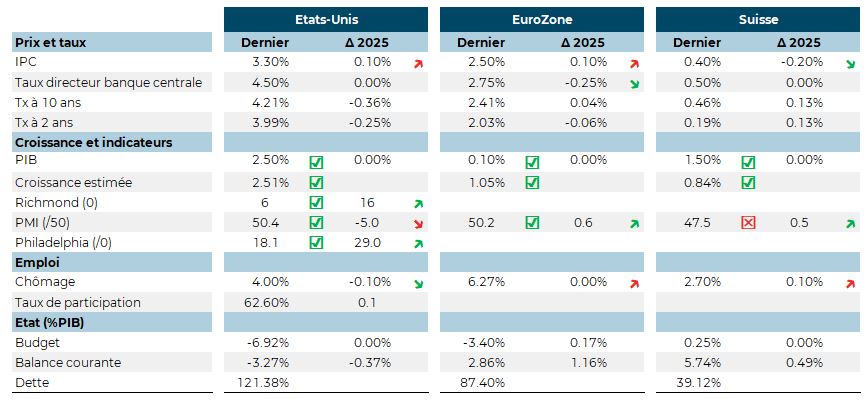

Inflation remains contained for the time being, but above the Fed’s targets. Jerome Powell

remains of the view that there is no urgent need to change monetary policy. This situation couldtherefore delay the rate cut or slow the pace of balance sheet reduction. If the Trump negotiations succeed, inflation figures could fall at the end of the year, leaving the Fed free to cut rates.

Donald Trump’s aim of revitalizing the US economy is to reduce the trade deficit. With record deficits of nearly USD 100 billion a year, the US is suffering from its imports. The strong US dollar continues to stand in the way of this policy, which is why the US President is pressing to lower rates and thus reduce the strength of the dollar, which is penalising the export industry.

European economic activity continues to grow slightly (PMI Flash), but this masks major disparities between countries. The economy, which was supposed to bring Europeans closer together politically, is becoming a divisive factor. In Great Britain, inflation figures are rising for food, transport and goods. Switzerland slows down in the fourth quarter of 2024, even though inflation is still very low.

Chinese figures are improving. The government says it is ready to help the private sector and is trying to counterbalance Donald Trump’s tariffs (+10% on products imported from China). Although the property sector is still struggling, optimism seems to be returning, reflected in the strong performance of Chinese technology stocks and the outperformance of Chinese equities relative to US equities in 2025.

Donald Trump is giving his instructions this January: lower oil prices, lower US interest rates. Unfortunately, neither seems to be responding to his demands. With inflation picking up slightly (2.9% in December), the FED is putting on hold the cycle of rate cuts that began in September. Powell cites domestic political uncertainty as one of the reasons for the pause. If the tariff barriers imposed on Canada, Mexico and China were to rise, excess inflation of between 0.5% and 2% could emerge. From the Fed’s point of view, it is therefore urgent to wait for Donald Trump to clarify the implementation of his policy agenda. And the slowdown in wage growth offers a counterbalance to the impact of the tariffs.

Donald Trump is giving his instructions this January: lower oil prices, lower US interest rates. Unfortunately, neither seems to be responding to his demands. With inflation picking up slightly (2.9% in December), the FED is putting on hold the cycle of rate cuts that began in September. Powell cites domestic political uncertainty as one of the reasons for the pause. If the tariff barriers imposed on Canada, Mexico and China were to rise, excess inflation of between 0.5% and 2% could emerge. From the Fed’s point of view, it is therefore urgent to wait for Donald Trump to clarify the implementation of his policy agenda. And the slowdown in wage growth offers a counterbalance to the impact of the tariffs.