XO INVESTMENTS’ services for private clients range from wealth management to pensions advice.

For once, the eyes of economic players are on Europe this March. The German elections saw the emergence of a new coalition. Germany’s budgetary shackles, and in particular the debt brake rules, seem to be bursting under pressure from employers. A 500 billion infrastructure plan will be put in place. A European defence plan is also under discussion within the EU. France and Germany are seeking to create a Europe of defence, 80 years after the first discussions on the subject… Figures of 800 billion are being evoked.

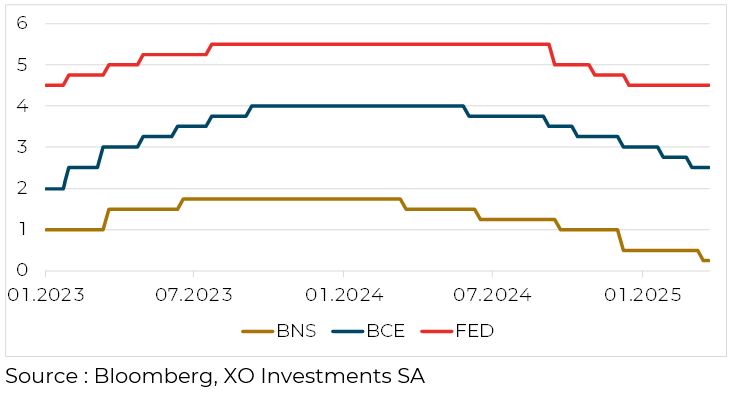

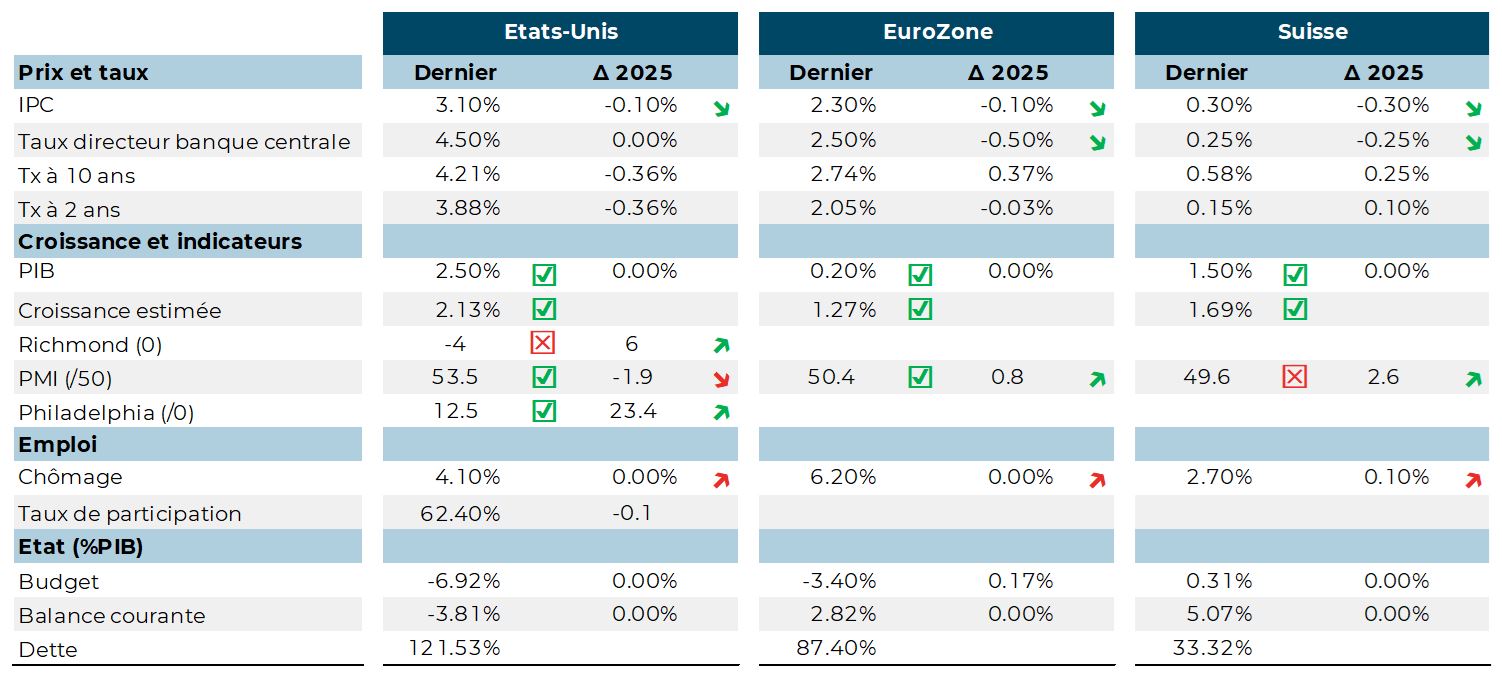

Weak growth in Europe and stable inflation have led the ECB to cut interest rates once again, to 2.5%. The ECB President now expects higher inflation and may decide to end her monetary easing cycle. The SNB also lowered rates to 0.25% under pressure from the slowdown in already low inflation. Rates on Swiss government bonds are now close to 0%.

Only the FED kept its key rate unchanged in March, and its policy diverged from that of the Europeans. Nevertheless, the FED Chairman’s speech now suggests that a rate cut may be resumed as soon as the uncertainty over tariff barriers is lifted.

This is probably influenced by the inflation figures, which are falling again in the United States, with CPI at 2.8% in February.

Discussions on the US budget are intense. The challenge is to find a financial balance that will allow Donald Trump to implement his tax reform (tax cuts for the least wealthy households in particular).

Consumption in China is rebounding faster than expected at the start of the year. This is offsetting the impact of US tariffs on Chinese exports. Low inflation has in fact led the government to unveil a special action plan to stimulate consumption in the country. The guidelines of this plan include measures such as stabilising the stock and property markets and incentives to increase the birth rate (childcare, wage increases, etc.). China’s GDP is therefore expected to grow by 2025.

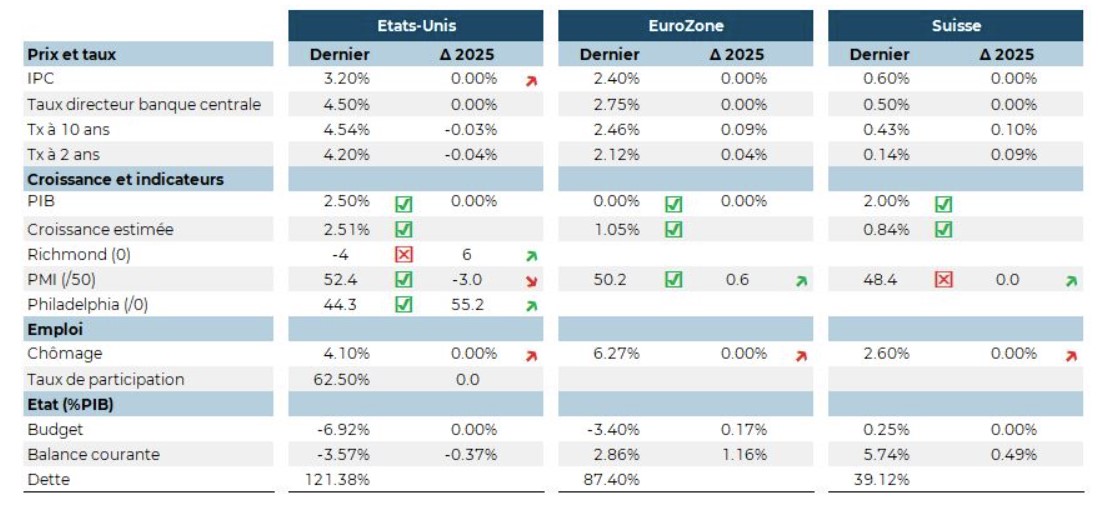

Donald Trump is giving his instructions this January: lower oil prices, lower US interest rates. Unfortunately, neither seems to be responding to his demands. With inflation picking up slightly (2.9% in December), the FED is putting on hold the cycle of rate cuts that began in September. Powell cites domestic political uncertainty as one of the reasons for the pause. If the tariff barriers imposed on Canada, Mexico and China were to rise, excess inflation of between 0.5% and 2% could emerge. From the Fed’s point of view, it is therefore urgent to wait for Donald Trump to clarify the implementation of his policy agenda. And the slowdown in wage growth offers a counterbalance to the impact of the tariffs.

Donald Trump is giving his instructions this January: lower oil prices, lower US interest rates. Unfortunately, neither seems to be responding to his demands. With inflation picking up slightly (2.9% in December), the FED is putting on hold the cycle of rate cuts that began in September. Powell cites domestic political uncertainty as one of the reasons for the pause. If the tariff barriers imposed on Canada, Mexico and China were to rise, excess inflation of between 0.5% and 2% could emerge. From the Fed’s point of view, it is therefore urgent to wait for Donald Trump to clarify the implementation of his policy agenda. And the slowdown in wage growth offers a counterbalance to the impact of the tariffs.