XO INVESTMENTS’ services for private clients range from wealth management to pension advice.

Donald Trump’s defiant stance and constant flip-flopping in trade negotiations should not obscure the positive reality: trade agreements are being signed step by step. After Vietnam and Indonesia, it is now Japan’s turn, before Europe finds a way out of the crisis

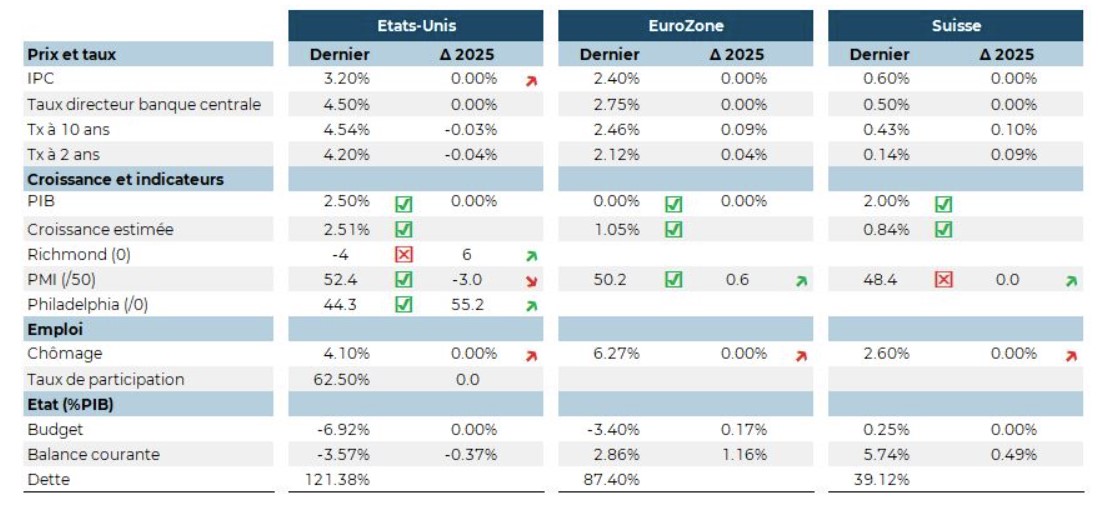

After a decline in GDP in the first quarter of 2025, growth expectations are slightly higher for the second quarter. The Purchasing Managers Index (PMI) is on the rise. It reflects the strength of economic activity, especially in the United States in the services sector. After months of contraction, this partial recovery is positive.

Although US consumption has been declining for five months, the unemployment rate remains robust at 3.8%. New home sales fell by 3.2% in June, while orders for durable goods rose by 1.6% over the same period.. These contradictory signals complicate monetary policy decisions, which must also contend with a

rebound in inflation. Indeed, the price index has risen to 3.6%, which tends to push back the date of the Fed’s rate cut. US banks believe that capital requirements are too restrictive for economic growth and are asking the Fed to relax them..

In France, mired in budget negotiations, several measures are coming into force this July: an increase in unemployment benefits and the end of the energy price cap. Corporate insolvency proceedings fell in June in the Netherlands and the United Kingdom, a sign of hope in an economic climate strained by customs negotiations. The ECB kept its key interest rates unchanged at the end of July, thanks to a slowdown in inflationary pressures. In Switzerland, the SNB’s rate cut is spreading in the form of negative rates for institutional investors. Business confidence is declining.

Les données officielles confirment un rebond solide au 2ème trimestre 2025 (+5.3% sur le semestre) malgré une consommation domestique et un investissement privé fragiles. Le méga-barrage hydroélectrique au Tibet a été lancé le 23 juillet pour relancer l’activité via les investissements publics dans les matériaux et l’énergie.

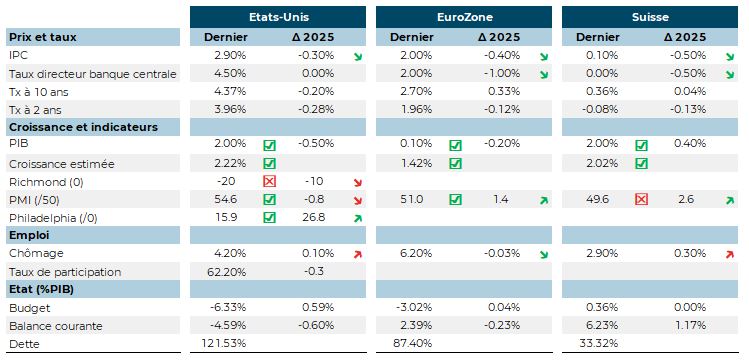

Donald Trump is giving his instructions this January: lower oil prices, lower US interest rates. Unfortunately, neither seems to be responding to his demands. With inflation picking up slightly (2.9% in December), the FED is putting on hold the cycle of rate cuts that began in September. Powell cites domestic political uncertainty as one of the reasons for the pause. If the tariff barriers imposed on Canada, Mexico and China were to rise, excess inflation of between 0.5% and 2% could emerge. From the Fed’s point of view, it is therefore urgent to wait for Donald Trump to clarify the implementation of his policy agenda. And the slowdown in wage growth offers a counterbalance to the impact of the tariffs.

Donald Trump is giving his instructions this January: lower oil prices, lower US interest rates. Unfortunately, neither seems to be responding to his demands. With inflation picking up slightly (2.9% in December), the FED is putting on hold the cycle of rate cuts that began in September. Powell cites domestic political uncertainty as one of the reasons for the pause. If the tariff barriers imposed on Canada, Mexico and China were to rise, excess inflation of between 0.5% and 2% could emerge. From the Fed’s point of view, it is therefore urgent to wait for Donald Trump to clarify the implementation of his policy agenda. And the slowdown in wage growth offers a counterbalance to the impact of the tariffs.