XO INVESTMENTS’ services for private clients range from wealth management to pension advice.

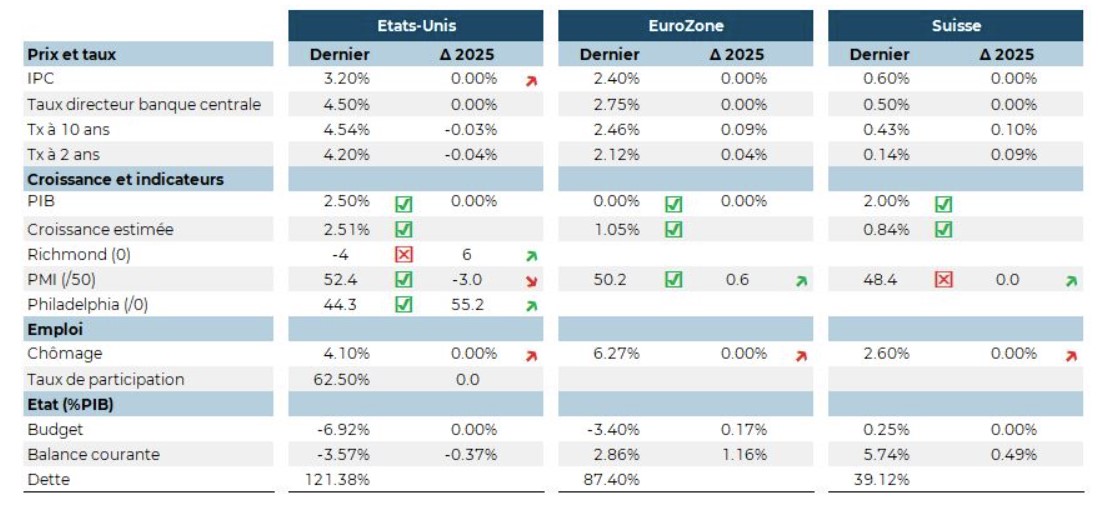

May was marked by an apparent lull on the markets, but this stability conceals persistent tensions on the macroeconomic front. The trajectory of interest rates remains the focus of attention, with the US Federal Reserve sticking to its guns despite growing signs of fragility in the real economy.

US inflation, although still contained, is accompanied by a steady rise in inflation expectations, fuelled by fears linked to the ongoing rise in tariffs and the firmness of monetary policy. The yield curve remains inverted (10 years – 2 years), signalling a growing probability of recession (35% according to the latest New York Fed models). Against this backdrop, consumer confidence continues to decline, wiping out the last few months of recovery seen in early 2024.

In Europe, uncertainty remains high, even if the announcements are less spectacular than on the other side of the Atlantic. Inflation remains broadly stable in the eurozone, but industrial activity continues to show signs of weakness, particularly in Germany. The increase in the minimum wage in Germany, due to come into effect in the autumn, is fuelling debate over a possible return to wage inflation. France, for its part, is seeking to reassure the markets: the government is maintaining its course of reducing the public deficit, despite growth assumptions that have been revised downwards. The rating agencies remain cautious; Moody’s is refraining from any updates, stressing the persistent political uncertainties.

In China, May was a month of reaction. The authorities announced a series of measures to support domestic demand, including targeted fiscal measures and the easing of credit conditions. The aim is clear: to limit the impact of the trade war on the most exposed sectors, at a time when exports to the United States are showing a temporary upturn. Beijing is also preparing new budgetary measures, despite the expected increase in the deficit.

International trade remains under pressure everywhere, and the world economy seems to be hanging on the trade and monetary policy decisions of the major powers. May was not a month of rupture, but rather a time of latent tension, when economic players watched without breathing…waiting for the next shock.

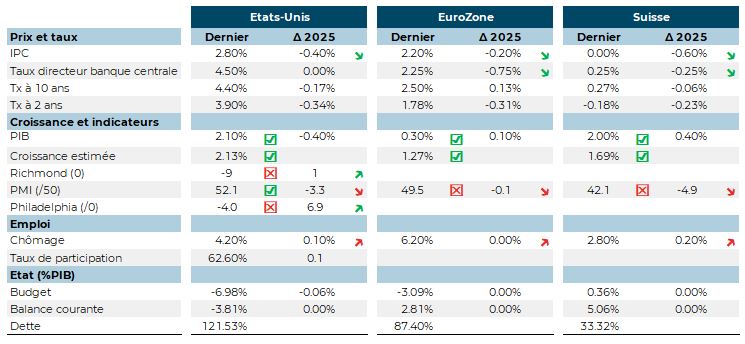

Donald Trump is giving his instructions this January: lower oil prices, lower US interest rates. Unfortunately, neither seems to be responding to his demands. With inflation picking up slightly (2.9% in December), the FED is putting on hold the cycle of rate cuts that began in September. Powell cites domestic political uncertainty as one of the reasons for the pause. If the tariff barriers imposed on Canada, Mexico and China were to rise, excess inflation of between 0.5% and 2% could emerge. From the Fed’s point of view, it is therefore urgent to wait for Donald Trump to clarify the implementation of his policy agenda. And the slowdown in wage growth offers a counterbalance to the impact of the tariffs.

Donald Trump is giving his instructions this January: lower oil prices, lower US interest rates. Unfortunately, neither seems to be responding to his demands. With inflation picking up slightly (2.9% in December), the FED is putting on hold the cycle of rate cuts that began in September. Powell cites domestic political uncertainty as one of the reasons for the pause. If the tariff barriers imposed on Canada, Mexico and China were to rise, excess inflation of between 0.5% and 2% could emerge. From the Fed’s point of view, it is therefore urgent to wait for Donald Trump to clarify the implementation of his policy agenda. And the slowdown in wage growth offers a counterbalance to the impact of the tariffs.