XO INVESTMENTS’ services for private clients range from wealth management to pension advice.

Switzerland is one of the countries hardest hit by the Trump administration’s customs duties, with tariffs of 39%. This 39% corresponds to the 39 billion trade deficit in goods between the United States and Switzerland. The 39 billion is largely due to exports of refined gold from Switzerland. While customs tariffs initially also applied to 1kg ingots, President Trump quickly changed his mind, ultimately exempting all gold exports, even though they were the cause of the US deficit…

The turnaround on gold is simply a consequence of Switzerland’s dominant position in refining. Indeed, 70% of global refining is carried out in Switzerland, so it is easy to understand how such restrictions would make it difficult for the United States to source precious metals.

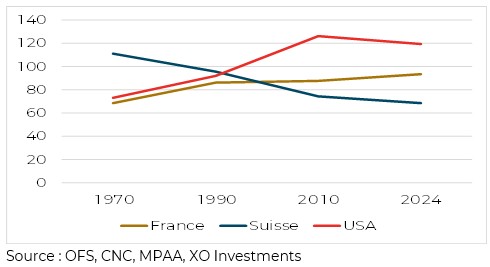

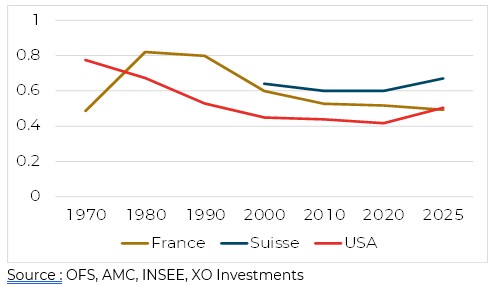

Si on normalise ces données en les retraitant par rapport à un million d’habitants, la Suisse a vu ses capacités de projection réduites de 60%. La France et les Etats-Unis voient leurs capacités augmenter, avec une légère baisse sur la dernière décennie pour les USA.

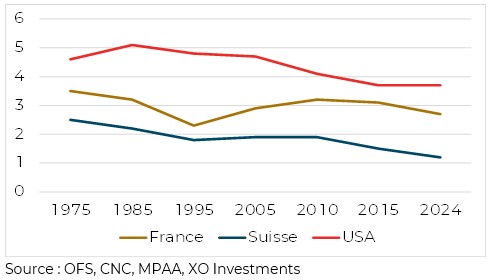

La demande est malheureusement orientée à la baisse depuis le début des années 1980 dans les 3 pays sélectionnés. Les populations vont moins souvent au cinéma. Un Américain moyen se déplace aujourd’hui 4 fois par an au cinéma contre 5 fois en 1985. En France la population se déplace en moyenne 3 fois par an pour voir un film, et seulement 1 fois pour un Suisse. La Suisse dénote donc par rapport aux autres pays.

Demand for gold has been slightly lower than supply for the past 10 years. Four major sectors account for this demand: jewellery (45%), technology (5%), investment (26%) and central banks (24%). The latter has seen the most growth since 2010. Demand from central banks has exceeded the increase in supply over the period. Central banks have therefore more than captured the growth in gold production since 2010.

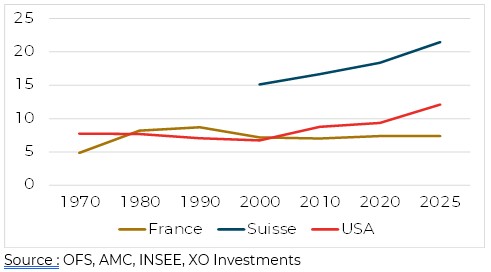

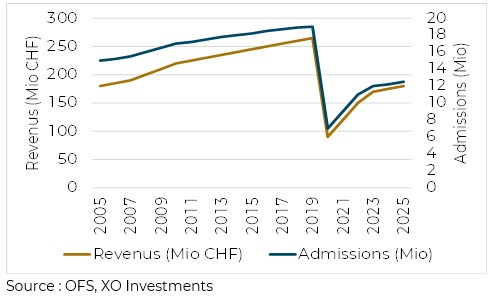

Avec une demande un peu moins élevée en Suisse, il n’est pas étonnant de constater des revenus du secteur en baisse depuis 20 ans. Avec des revenus globaux de 180 millions, 2025 est similaire à 2005, loin derrière 2019 (260 millions) mais en récupération depuis le Covid. Le revenu par salle en Suisse est constant depuis 2000 avec environ CHF 600’000.

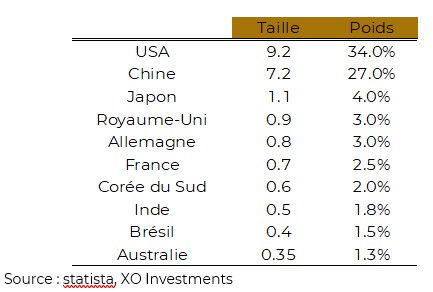

Nevertheless, the proportions vary greatly from one country to another. The United States remains the largest holder of gold, even though an audit of reserves, which have not been audited since 1954, promised by E. Musk, has not yet been carried out. European countries follow (Italy, France, Switzerland) as well as the major players in this world: Russia, China, India and Japan.

Changes in central bank holdings reflect geopolitical dynamics. For the past 25 years, Russia and China have been buying gold on a massive scale, acquiring nearly 2,000 tonnes. While Russia stepped up its purchases with the onset of the Ukrainian crisis in 2014, China has been proceeding in stages. The last three years have been marked by continuous purchases every month. On the other side of the spectrum, France and Switzerland sold gold in the early 2000s.

Thus, the percentage of reserves allocated to gold is rising sharply in Russia and China, although the latter still lags far behind European countries. It is difficult to imagine the massive purchases that would be necessary to achieve a similar percentage of holdings…

Every year, the World Gold Council conducts a survey of central bankers (73 respondents in 2025). This survey highlights a number of phenomena, in particular the place of gold in estimated reserves over the next five years. Three-quarters of respondents in 2025 believe that gold will see its share increase over the next five years. This sentiment is growing stronger with each passing year.

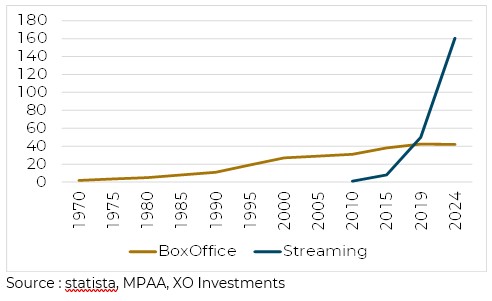

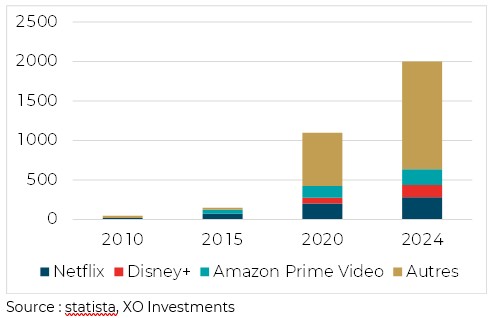

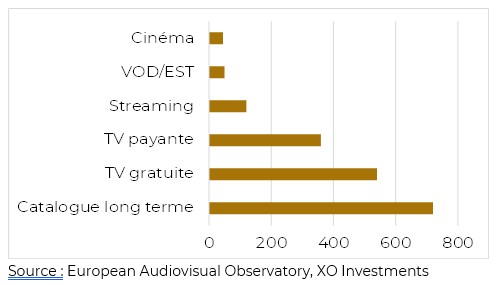

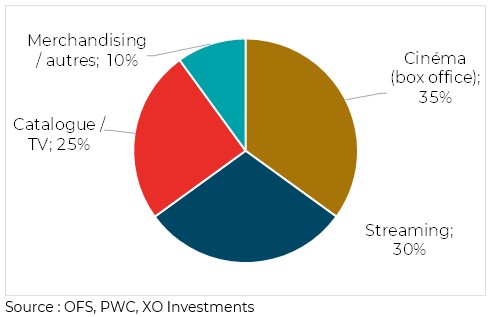

Le Box-Office représente le début du cycle de vie d’un film et plus l’entier de sa vie. Avec environ 30 à 50 jours de programmation dans les salles obscures, c’est la première étape d’un cycle qui passera ensuite par le Streaming, la télévision puis le catalogue à long terme des diffuseurs.

Over the next 12 months, 95% of respondents believe that gold reserves will increase on balance sheets, and 43% anticipate an increase on their own central bank balance sheets. This is therefore a major signal of central bank behaviour. It is mainly the central banks of emerging countries that are moving in this direction, confirming the massive purchases made by Russia and China.

L’économie du cinéma et de l’audiovisuel se modifie progressivement devant nos yeux. Les fenêtres de diffusion se réduisent. La salle de cinéma perd de son exclusivité, ce qui accentue la pression économique sur les cinémas. Le streaming est un véritable pivot qui représente la principale source de revenus post-salle. Les salles ont donc moins de temps pour amortir un film, ce qui fragilise les exploitants indépendants. L’histoire de nombre d’industries (commerce de détail, services,…)

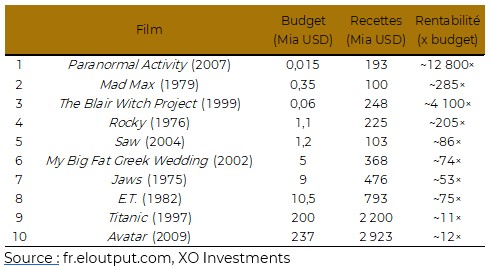

Mais finalement, qu’allons-nous regarder lors des fêtes de fin d’année ? Probablement un blockbuster. Si on cherche à regarder le film le plus générateur de profits de l’histoire, il faudra visionner Avatar (2009) avec près de 3 trilliards d’USD de recettes. Mais ce n’est que le 10ème film en termes de rentabilité. Si on s’intéresse à ce critère il faudra regarder Paranormal Activity (2007) qui a permis de réaliser un record de 12’900 fois le budget investi… Noël avant l’heure !

The management of a central bank’s balance sheet serves many purposes. The three main areas of interest identified in the annual study on central bank reserves are interest rate management, inflation management and geopolitics. However, the issues considered relevant by central bankers differ between central banks in Western countries and those in emerging countries.

For example, ESG (Environmental, Social and Governance) is a Western concern, not an emerging one. Conversely, central banks in emerging countries give greater weight in their decisions to issues such as trade conflicts, shifts in economic power, geopolitics and geopolitical polarisation. The world is gradually fragmenting into two camps.