XO INVESTMENTS’ services for private clients range from wealth management to pension advice.

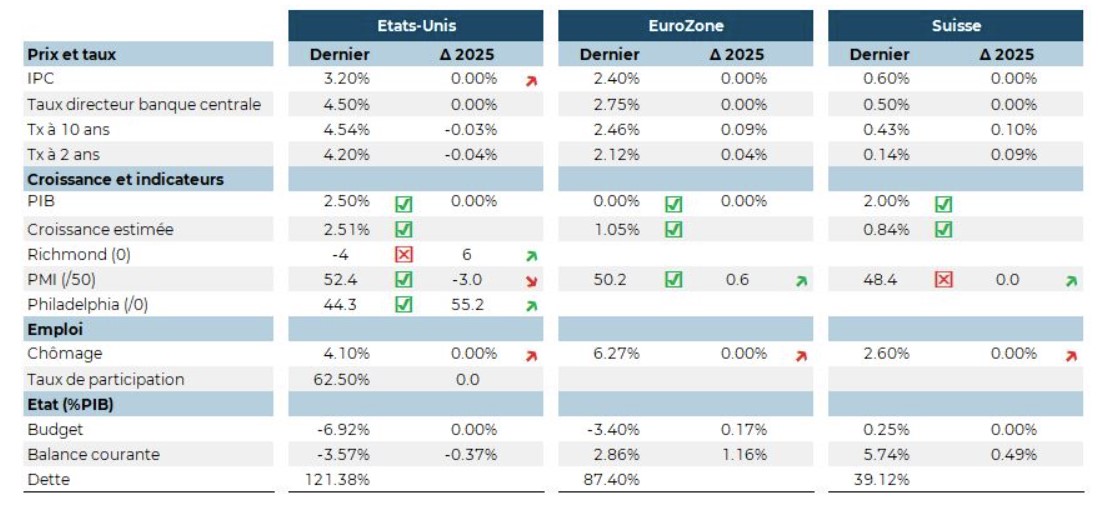

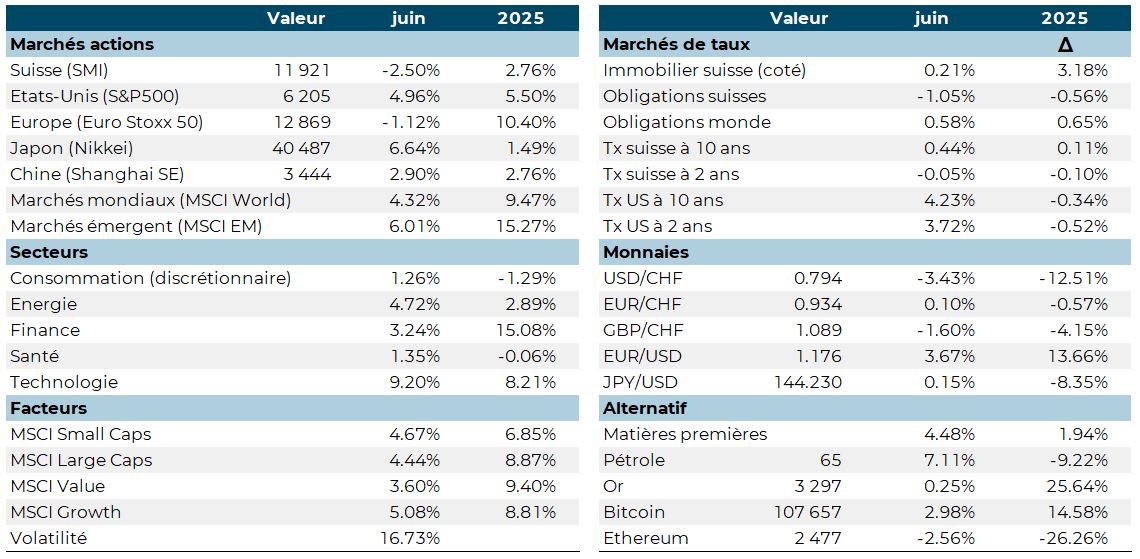

The embers are being fanned by a violent wind in the Middle East. The war in Palestine and the growing conflict between Israel and Iran are driving up the price of oil, which has been back in positive territory since 1 January, and consequently energy stocks, which had been penalised until now. The markets are fluctuating between fears of an intensification of the conflict in the Middle East, while remaining on tenterhooks over discussions on US customs barriers. The month of July is expected to deliver a ‘customs’ verdict, which is paralysing the financial markets in June. As a result, equity markets are in a holding pattern, posting broadly neutral performances compared with previous months of high volatility.

Interest rates were stable in June, leading to little movement on the bond markets. Only Swiss property prices have continued to rise since 1 January. As for currencies, the USD is still under pressure, while the EUR remains strong. Gold followed oil with a clear advance in June, while Bitcoin hit a new all-time high.

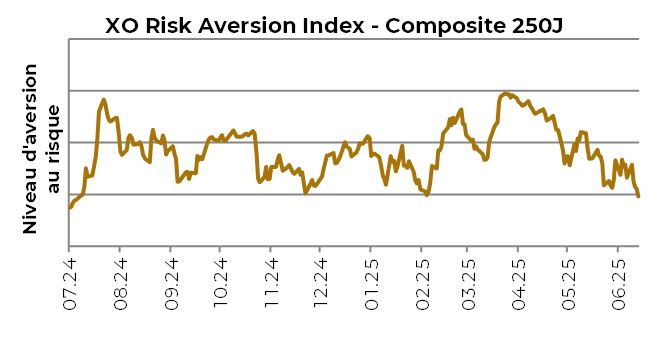

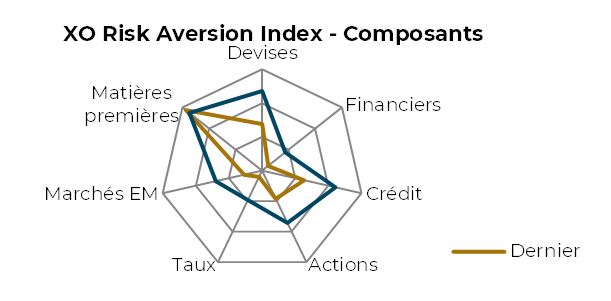

The risk indicator fell in June, as did all the sub-indices except commodities.

Donald Trump is giving his instructions this January: lower oil prices, lower US interest rates. Unfortunately, neither seems to be responding to his demands. With inflation picking up slightly (2.9% in December), the FED is putting on hold the cycle of rate cuts that began in September. Powell cites domestic political uncertainty as one of the reasons for the pause. If the tariff barriers imposed on Canada, Mexico and China were to rise, excess inflation of between 0.5% and 2% could emerge. From the Fed’s point of view, it is therefore urgent to wait for Donald Trump to clarify the implementation of his policy agenda. And the slowdown in wage growth offers a counterbalance to the impact of the tariffs.

Donald Trump is giving his instructions this January: lower oil prices, lower US interest rates. Unfortunately, neither seems to be responding to his demands. With inflation picking up slightly (2.9% in December), the FED is putting on hold the cycle of rate cuts that began in September. Powell cites domestic political uncertainty as one of the reasons for the pause. If the tariff barriers imposed on Canada, Mexico and China were to rise, excess inflation of between 0.5% and 2% could emerge. From the Fed’s point of view, it is therefore urgent to wait for Donald Trump to clarify the implementation of his policy agenda. And the slowdown in wage growth offers a counterbalance to the impact of the tariffs.