XO INVESTMENTS’ services for private clients range from wealth management to pension advice.

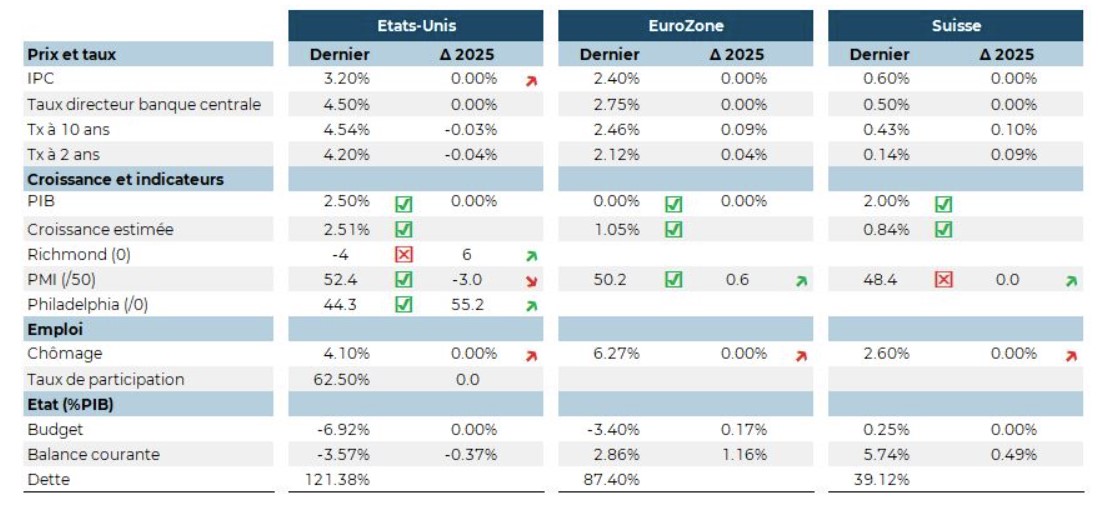

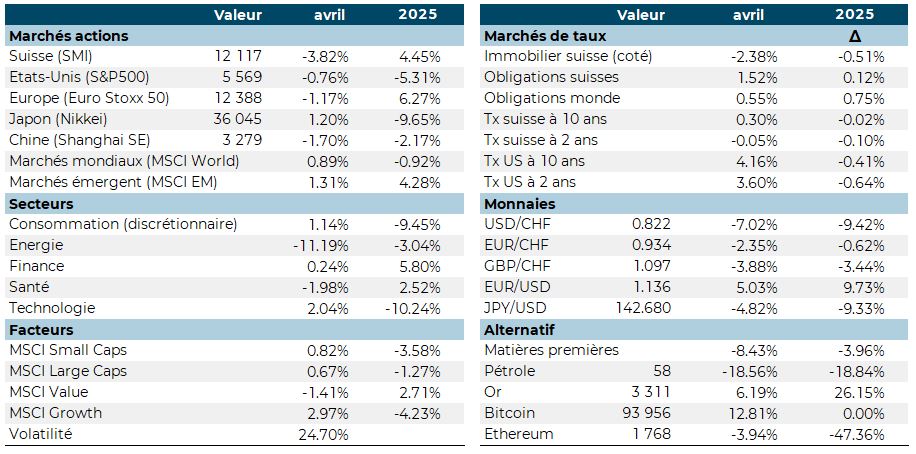

The adage “in April, don’t let the cat out of the bag” should have been interpreted literally by investors this April, by hedging market and currency risks. Indeed, a chill wind blew in at the beginning of the month with Donald Trump’s “Liberation Day”. Equity markets were swept into a whirlwind by this trade war. The VIX fear index reached 60% during the month, levels reminiscent of the Covid crisis in March 2020.

All equity markets were affected by this movement, with China – the most targeted economically – surprisingly the least impacted on the stock markets. Fears of an economic slowdown particularly affected energy stocks.

Interest rates showed considerable volatility over the month, but ultimately remained fairly stable. Swiss bonds benefited from the movement, while Swiss real estate was negatively impacted.

The USD is depreciating sharply against the CHF and EUR. CHF acts as a safe haven. Oil is down sharply, while gold is breaking record after record.

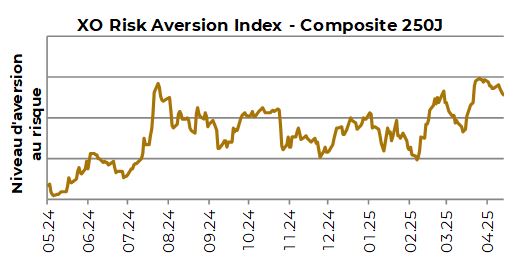

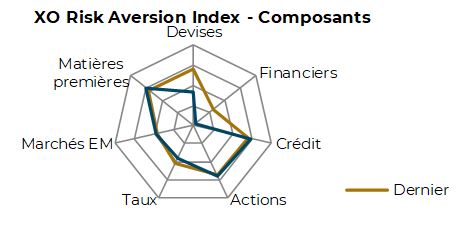

The risk indicator oscillates between the high-risk and median zones. All sub-indices are up.

Donald Trump is giving his instructions this January: lower oil prices, lower US interest rates. Unfortunately, neither seems to be responding to his demands. With inflation picking up slightly (2.9% in December), the FED is putting on hold the cycle of rate cuts that began in September. Powell cites domestic political uncertainty as one of the reasons for the pause. If the tariff barriers imposed on Canada, Mexico and China were to rise, excess inflation of between 0.5% and 2% could emerge. From the Fed’s point of view, it is therefore urgent to wait for Donald Trump to clarify the implementation of his policy agenda. And the slowdown in wage growth offers a counterbalance to the impact of the tariffs.

Donald Trump is giving his instructions this January: lower oil prices, lower US interest rates. Unfortunately, neither seems to be responding to his demands. With inflation picking up slightly (2.9% in December), the FED is putting on hold the cycle of rate cuts that began in September. Powell cites domestic political uncertainty as one of the reasons for the pause. If the tariff barriers imposed on Canada, Mexico and China were to rise, excess inflation of between 0.5% and 2% could emerge. From the Fed’s point of view, it is therefore urgent to wait for Donald Trump to clarify the implementation of his policy agenda. And the slowdown in wage growth offers a counterbalance to the impact of the tariffs.