XO INVESTMENTS’ services for private clients range from wealth management to pension advice.

Economic players have noticed that after months of uninterrupted growth, the financial markets are taking a break this November. Only the Swiss market is emerging from this fog thanks to an agreement to reduce US customs tariffs from 39% to 15%. Roche shares are doing even better, jumping 20% following EU approval for the eye preparation Lunsimio. The performance gap between Switzerland and other Western countries is narrowing. Growth stocks are particularly affected by this reversal in trend but remain the best performers of the year.

Long-term interest rates rose slightly, affecting the markets and real estate. Bond performance was poor over the year.

Precious metals stabilised after a tremendous year. Oil, meanwhile, fell by almost 20% over the year. This is a future growth driver.

The risk indicator is in neutral territory. The commodities, equities and financials sub-indices are in high-risk territory.

.

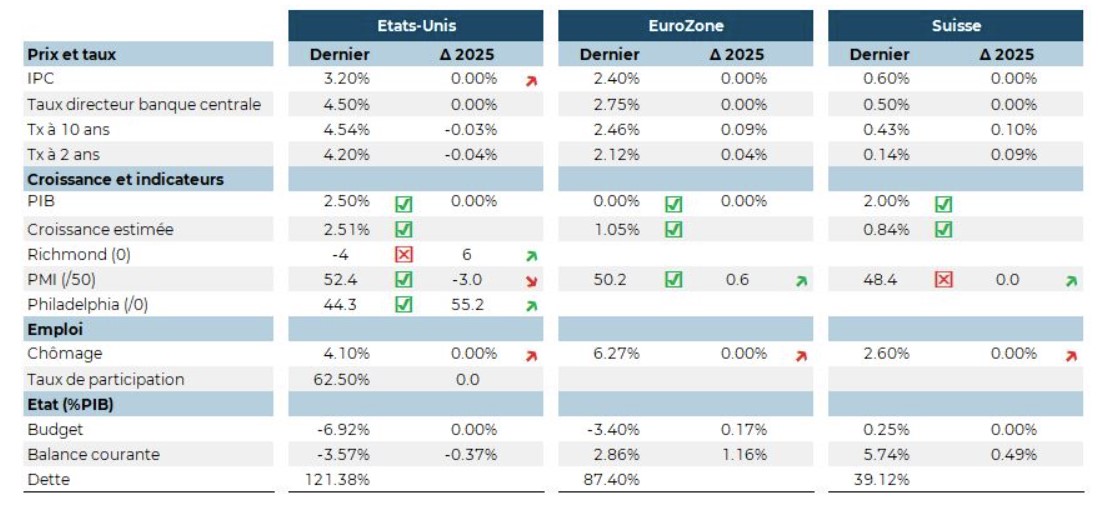

Donald Trump is giving his instructions this January: lower oil prices, lower US interest rates. Unfortunately, neither seems to be responding to his demands. With inflation picking up slightly (2.9% in December), the FED is putting on hold the cycle of rate cuts that began in September. Powell cites domestic political uncertainty as one of the reasons for the pause. If the tariff barriers imposed on Canada, Mexico and China were to rise, excess inflation of between 0.5% and 2% could emerge. From the Fed’s point of view, it is therefore urgent to wait for Donald Trump to clarify the implementation of his policy agenda. And the slowdown in wage growth offers a counterbalance to the impact of the tariffs.

Donald Trump is giving his instructions this January: lower oil prices, lower US interest rates. Unfortunately, neither seems to be responding to his demands. With inflation picking up slightly (2.9% in December), the FED is putting on hold the cycle of rate cuts that began in September. Powell cites domestic political uncertainty as one of the reasons for the pause. If the tariff barriers imposed on Canada, Mexico and China were to rise, excess inflation of between 0.5% and 2% could emerge. From the Fed’s point of view, it is therefore urgent to wait for Donald Trump to clarify the implementation of his policy agenda. And the slowdown in wage growth offers a counterbalance to the impact of the tariffs.