XO INVESTMENTS’ services for private clients range from wealth management to pensions advice.

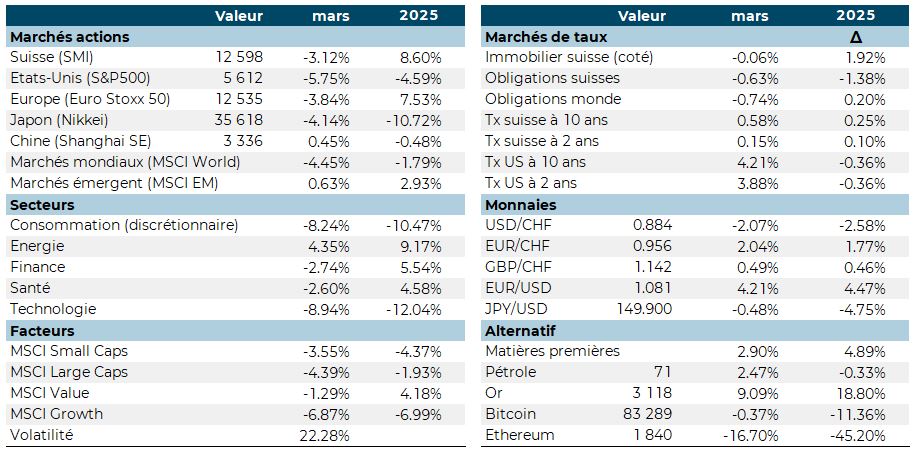

The peace negotiations between the United States and Russia over the Ukrainian conflict are leading Europeans to show their muscles and increase their military spending. This boosted European markets, which confirmed their broad outperformance over the year compared with US markets. Both Switzerland and Europe posted returns approaching 10%, while the US markets lagged behind. The United States was particularly affected by the behaviour of technology stocks, which were neglected by investors at the start of the year. Value stocks are thus making a comeback at the expense of growth stocks.

Interest rates rose over the month, even though the ECB and SNB cut their key rates. This rise in long-term rates is affecting bond performance, particularly on the Swiss market. Property prices also fell, but remained positive over the year.

Interest rates rose over the month, even though the ECB and SNB cut their key rates. This rise in long-term rates is affecting bond performance, particularly on the Swiss market. Property prices also fell, but remained positive over the year.

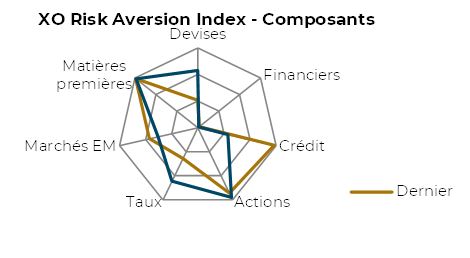

After peaking at the beginning of the month, the risk indicator is now back in the median zone. The credit, commodities and equities sub-indices are currently the riskiest.

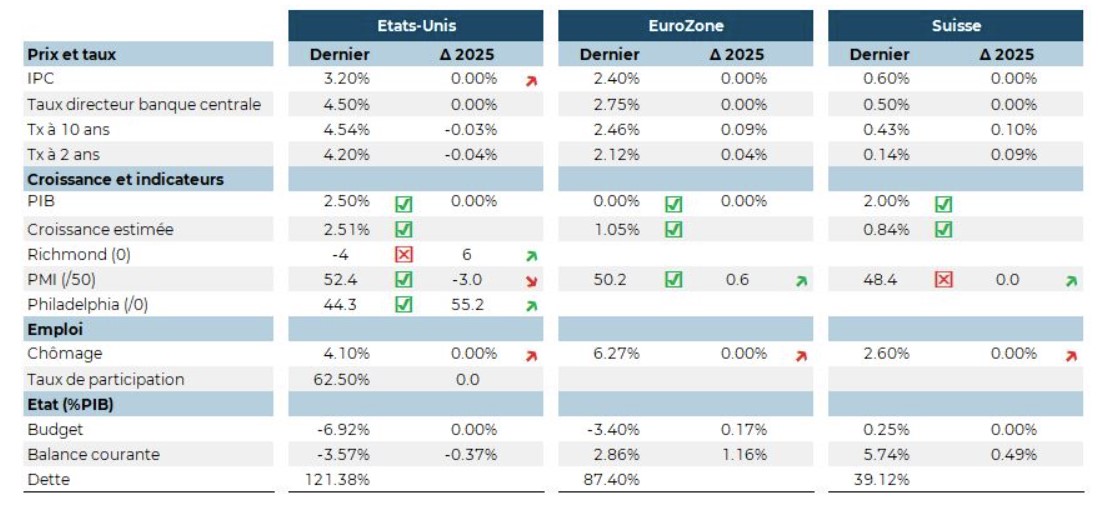

Donald Trump is giving his instructions this January: lower oil prices, lower US interest rates. Unfortunately, neither seems to be responding to his demands. With inflation picking up slightly (2.9% in December), the FED is putting on hold the cycle of rate cuts that began in September. Powell cites domestic political uncertainty as one of the reasons for the pause. If the tariff barriers imposed on Canada, Mexico and China were to rise, excess inflation of between 0.5% and 2% could emerge. From the Fed’s point of view, it is therefore urgent to wait for Donald Trump to clarify the implementation of his policy agenda. And the slowdown in wage growth offers a counterbalance to the impact of the tariffs.

Donald Trump is giving his instructions this January: lower oil prices, lower US interest rates. Unfortunately, neither seems to be responding to his demands. With inflation picking up slightly (2.9% in December), the FED is putting on hold the cycle of rate cuts that began in September. Powell cites domestic political uncertainty as one of the reasons for the pause. If the tariff barriers imposed on Canada, Mexico and China were to rise, excess inflation of between 0.5% and 2% could emerge. From the Fed’s point of view, it is therefore urgent to wait for Donald Trump to clarify the implementation of his policy agenda. And the slowdown in wage growth offers a counterbalance to the impact of the tariffs.