Russia sanctions in the service of gold

The yellow metal is among the least negative assets over 2022. And the sanctions imposed on Russia could give a boost to gold purchases as a reserve asset for central banks.

Gold ended 2022 with a performance of -0.28%, almost neutral. This result makes it one of the best asset of the last year. Only energy commodities can claim to have made better progress.

Despite this flattering outcome, it was not a flat year for the most important precious metal. The war in Ukraine allowed gold to return to its all-time high of $2,070 per ounce in March. Then the rise in US interest rates weighed heavily on its value and led to a return to $1,616 an ounce at the beginning of November before returning to the price at the beginning of the year at $1,800.

Evolution of the price of gold ($ ounce)

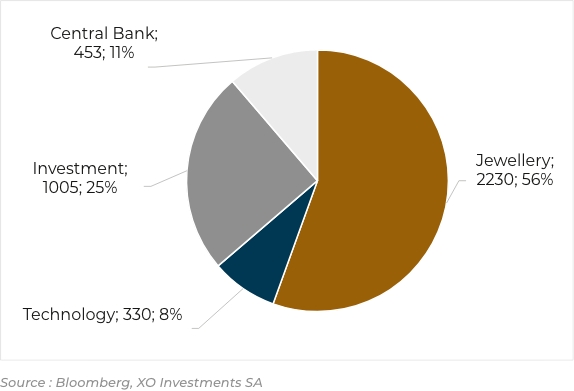

Gold is continuing a trend that began at the turn of the millennium. Most of the demand comes from jewellery. Investments (e.g. ETF purchases) account for 25% of demand. This is followed by central bank purchases and technology.

Demand for gold, 2021 (t)

The appetite of central banks

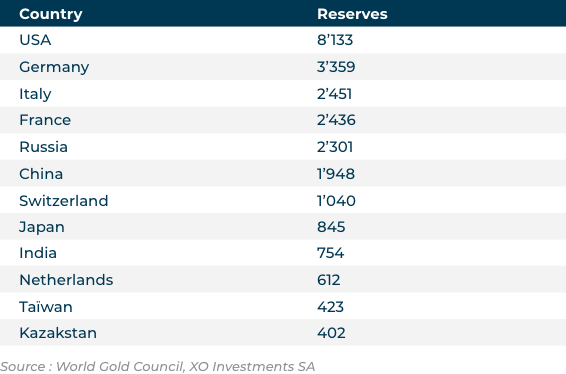

Central banks remain the largest holders of physical gold stocks. The US holds over 8,000 tonnes of gold in the FED. Western countries hold the largest gold reserves in their central banks, but new countries are appearing in this ranking. Russia, Taiwan and Kazakhstan all report large amounts.

Central bank gold reserves (t)

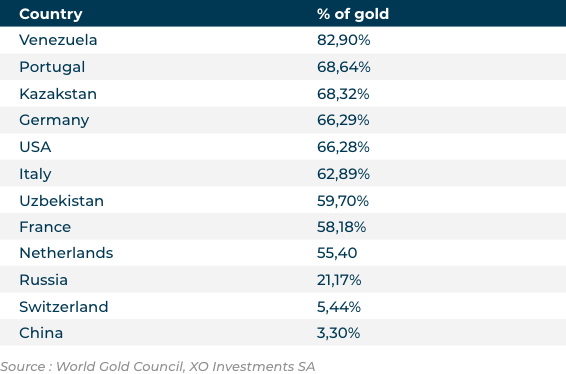

In terms of weight in total central bank reserves, the picture is somewhat different. Venezuela, a country under US sanctions, holds over 82% of its reserves in gold. Switzerland holds only 5%, following the explosion of its balance sheet in an effort to reduce the attractiveness of the CHF.

% of gold for Central Banks

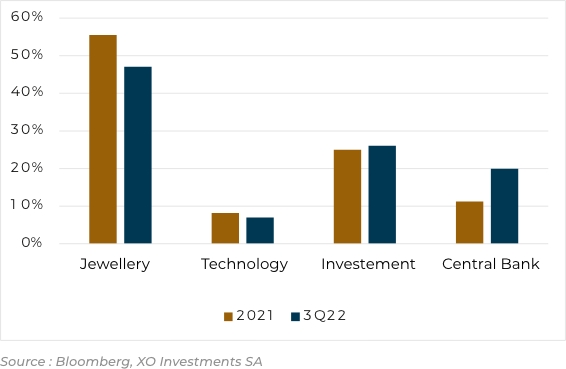

Central bank purchases account for just over 10% of annual demand. But the trend seems to be accelerating. In the first 9 months of 2022, 20% of global gold demand comes from central banks.

Demand for gold

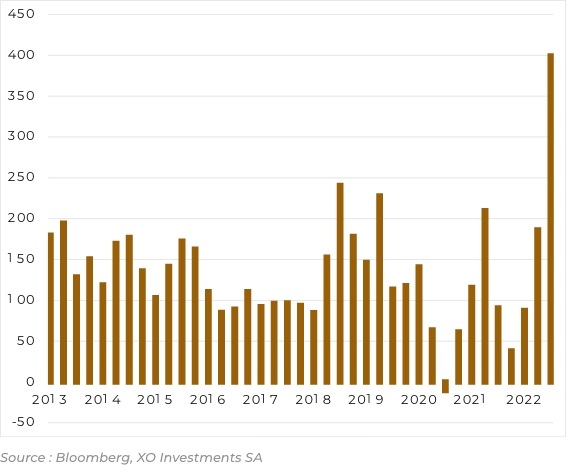

Purchases therefore increased massively in 2022, starting in the third quarter, a record period with 400 tonnes purchased.

Central bank demand for gold (t)

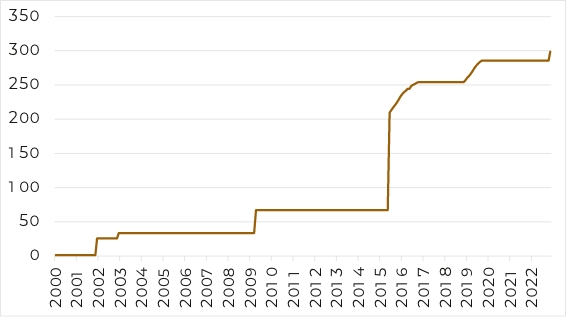

The stock of gold held by all central banks has been growing for over 10 years. It is now back to the level of the 1970s with almost 37,000 tonnes of gold. This corresponds to 20% of all the gold mined since the beginning of its exploitation by man (190,000 tonnes in total).

Centrail bank gold reserves (t)

Eurasian central banks, allies of Russia, are important buyers. China has also just announced an increase in its gold reserves to 300 tonnes. This figure should be treated with caution, as it seems to be underestimated.

Gold reserves of the Chinese central bank (t)

Demand will increase further

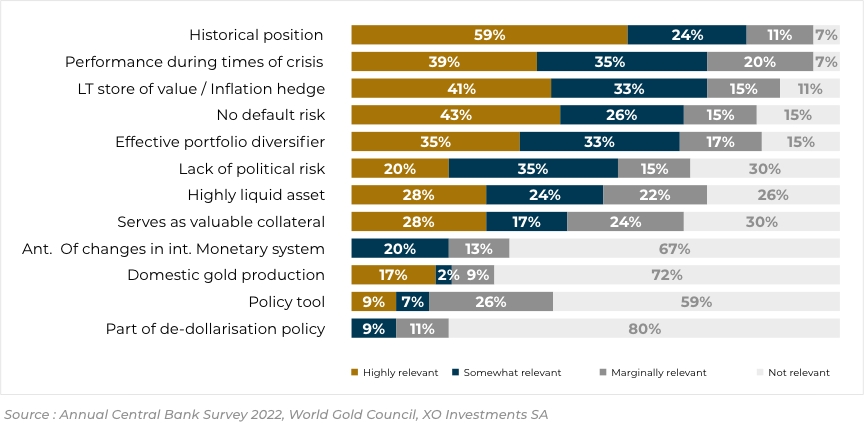

The change in the behaviour of central banks coincides with a change in their reasoning. The reasons for holding are gradually adapting to new geopolitical or economic conditions. According to the World Gold Council's annual survey, central banks hold gold mainly because it is a historical position, because gold performs well in a crisis, because it is a hedge against inflation or a store of value, and because it is unlikely to default. Gold continues to be viewed favourably by central bankers in their reserve assets.

Rational of central banks

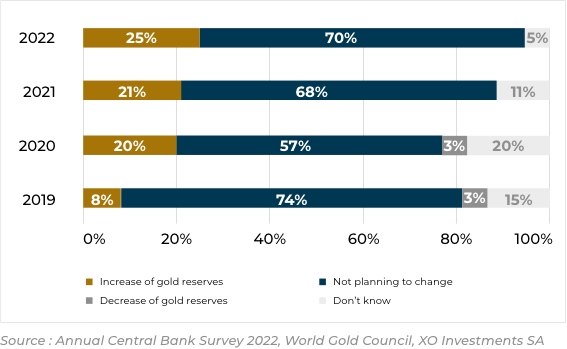

More interestingly, 25% of central bankers plan to buy gold in the next 12 months. This figure has been rising for the past 4 years. And only 5% of central banks plan to sell gold.

Central banks expectations on their reserves in the next 12 months

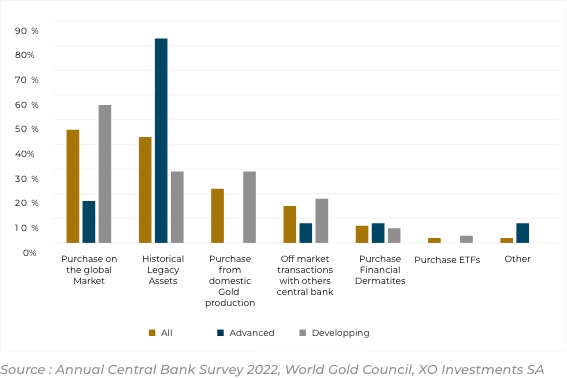

Clearly, the purchasing channels of central banks are different if the central bank is from an advanced or an emerging country. Developing countries buy mainly on the markets or from their domestic production.

Central bank purchasing channels

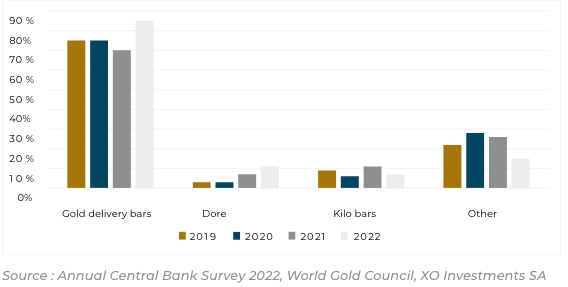

Form of central bank purchases

The role of gold in central bank reserves

The war in Ukraine will have a significant impact on central bank reserves. The freezing of Russian central bank assets in Europe and the US is an unprecedented measure. Gold has the advantage that if it is stored domestically it cannot be seized. Thus, even if it is not possible to use it to carry out all the classic transactions carried out by a central bank (intervention in the foreign exchange market with swaps to other central banks for example), gold is useful in terms of its capacity to protect reserves.

The sanctions on Russia will therefore lead central banks, especially in developing countries, to pay particular attention to geopolitical factors in their management of central bank reserves. As foreign exchange reserves are less secure than initially expected, governments and central bankers will be tempted to reduce the share of USD and EUR in their balance sheets, but also to turn to precious metals and other commodities.

The reduced holding of foreign currencies will lead central banks to accept greater fluctuations in their currencies or force them to impose administrative measures to limit movements such as capital flow controls.

Commodities could become a more important asset on central banks' balance sheets than at present, such as "unconventional" assets.They will have the choice of holding these new types of assets on their balance sheet or transferring ownership to an arm of government or, better still, to a sovereign wealth fund.

The year 2023 may confirm the beginning of this new monetary system logic. We will have to keep a close eye on the flow of gold purchases by central banks, particularly from the BRICS countries. Gold could also be the salvation of Western countries and their central banks, which have huge balance sheets. The revaluation of gold would allow a rebalancing of assets and debts. The Russian intervention in Ukraine is a turning point in history.