Market review

ON A SAMBA TUNE

February is approaching with its traditional carnivals. The markets have anticipated this by posting a general rise in all assets. January is the exact opposite of 2022.

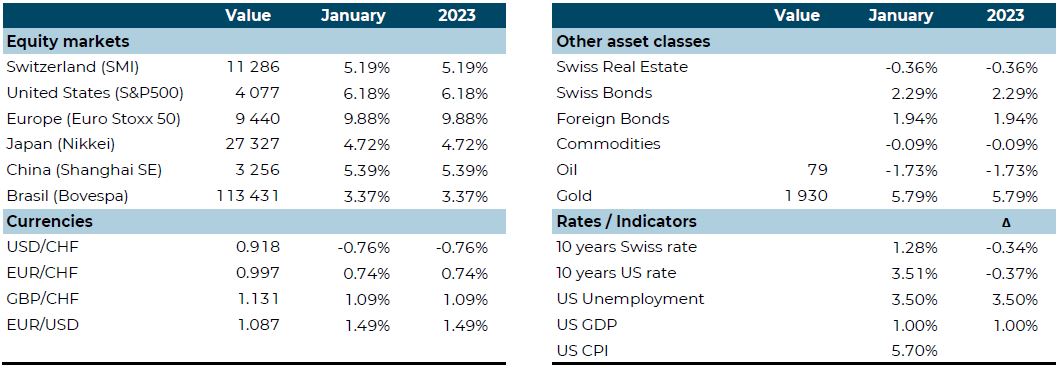

Equities are starting 2023 with a bang. Brazilian companies, although affected by the massive protests of former President Bolsonaro's supporters, rose but lagged Western markets. Europe was the strongest performer, up over 10%.

Interest rates are easing, allowing bonds and real estate assets to start the new year positively, leaving behind one of the worst performances in their history.

In terms of currencies, the USD fell slightly, under pressure from expectations of a reduction in the Fed's rate hike, while the EUR strengthened. Gold continued to perform well in the last quarter, rising by almost 6%.

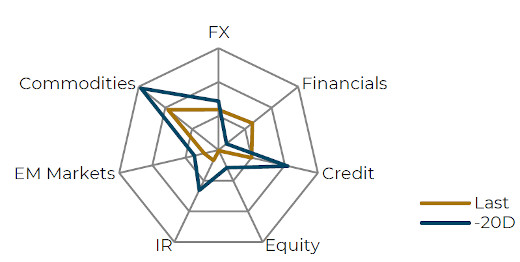

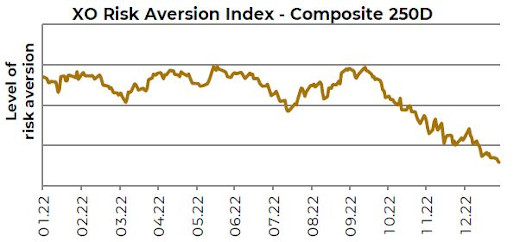

The overall risk indicator is still falling with only one component whose risk is rising: commodities.

MAIN performances

XO Risk Aversion Index - Composite 250D

XO Risk Aversion Index - Components